Forex brokers are middlemen who provide a platform for trading financial instruments. Their services connect traders to the financial market, making them crucial when it comes to trading.

It is important to note that while forex brokers play a vital role in financial instruments trading, there are some brokers who are fraudulent and scam traders of their money. To avoid this, you should only trade with regulated brokers as they are obliged by law to protect clients’ funds and provide transparent and fair trading services.

The Financial Sector Conduct Authority (FSCA) is the agency of the government of South Africa that regulates the activities of forex brokers in South Africa and sets out their rules for operations. The FSCA rules are in place to protect traders based in South Africa, so you can complain to them at any time if a broker violates the rules, and they will help you get redress.

However, if you trade with a broker that is not regulated by FSCA, the agency will not be able to protect you as the said broker is not in its jurisdiction and therefore not obliged to follow the FSCA rules.

In this post, we will examine six forex brokers regulated by FSCA in South Africa and compare their offerings as of September 2024. We will look at regulation dates, account types, minimum deposits, fees (trading & non-trading), available tradable instruments, trading platforms and customer support.

Comparison of FSCA Regulated Forex Brokers

| Broker | FSP Number | Authorised Since | Min. Deposit | Visit |

|---|---|---|---|---|

| Plus500 | 47546 |

2017

|

R750

|

Visit Broker |

| Exness | 51024 |

2020

|

R180 ($10)

|

Visit Broker |

| HF Markets | 46632 |

2016

|

R100

|

Visit Broker |

| FXCM | 46534 |

2016

|

R900 ($50)

|

Visit Broker |

| Tickmill | 49464 |

2019

|

R1,800 ($100)

|

Visit Broker |

| AvaTrade | 45984 |

2015

|

R1,950

|

Visit Broker |

Note: The average/typical spread and the minimum deposit is as per information on these brokers’ websites in September 2024. Please see the general trading conditions below.

Best FSCA Regulated Forex Brokers

Here are 2024’s best FSCA-regulated forex brokers in South Africa:

- Plus500 – FSCA Regulated Forex Broker with 24/7 customer support

- Exness – FSCA Regulated Broker with No inactive account fees

- HF Markets – Forex Broker with FSCA Regulation

- FXCM– FSCA Regulated Broker with Commission-free Trading

- Tickmill – FSCA Regulated Broker with ZAR as Account Currency

- AvaTrade – FSCA Regulated Broker with Negative Balance Protection

#1 Plus500 – FSCA-Regulated Forex Broker with 24/7 Customer Support

Plus500 is regulated in South Africa by FSCA as Plus500AU Pty Ltd. and licensed to operate as financial services provider (FSP) with FSP number 47546, issued in 2017.

Account types: Plus500 has only one account type for clients in South Africa, which is the Retail Account with maximum leverage of 1:30. You can only open individual accounts with this broker. Plus500 offers negative balance protection to traders, which means you cannot lose more than your deposits even if you suffer a loss in a trade.

Fees: Trading fees on Plus500 are spreads, currency conversion fees, and swap fees. Plus500 does not charge commissions on all instruments. Plus500 offers free deposits and withdrawals but charges dormant accounts after 3 months of inactivity.

Tradable Instruments: Financial instruments that you can trade on Plus500 South Africa are CFDs on forex currency pairs, shares, indices, commodities (oil, metals, and agriculture), cryptocurrencies, options, and ETFs.

Deposits/Withdrawals: You can deposit and withdraw from Plus500 with cards and bank transfers. Cards and e-wallets deposits are credited instantly and it takes up to 5 days for bank wire transfers. Withdrawals are processed within 1-3 business days and may take more days for you to receive funds.

Trading Platforms and Support: Plus500 supports a proprietary trading application – Plus500 Trader. The application is available on the web version, desktop and mobile devices (iOS and Android). Plus500 offers 24/7 Customer support via live chat, email and social media for traders in South Africa.

#2 FSCA Regulated Broker with No Inactive Account Fees

Exness is regulated in South Africa by FSCA as Exness ZA (Pty) Ltd and licensed to offer Financial Services with company Financial Service Provider (FSP) number 51024, issued in 2020.

Account types: Account types available on Exness are Standard Accounts and Professional Accounts which has varying features.

They are further divided into Standard and Standard Cent Account under the standard category, as well as Raw Spread, Zero and Pro Accounts on the professional category.

Exness also offers Social Trading Accounts and Portfolio Management Accounts. You can also request for a swap-free that conforms with Islamic principles.

You can open an account as an individual or corporate entity on Exness. The maximum leverage on Exness is 1:2,000. Although your maximum leverage reduces as your account becomes bigger and can be as low as 1:500 when your account equity exceeds $30,000. Exness also offer negative balance protection.

Fees: Trading fees charged by Exness are spreads, commissions on Raw Spread and Zero Accounts, and swap fees. The broker does not charge commissions on Standard Accounts trades. Exness does not charge any fees for deposits or withdrawals, and there is no account inactivity fee.

Tradable Instruments: Available financial instruments on Exness in South Africa for trading are CFDs on forex currencies pairs, stocks, indices, energies, cryptocurrencies, and metals.

Deposits/Withdrawals: Payment methods supported on Exness for deposits and withdrawals in South Africa are cards (debit/credits), e-wallets (Ozow, Mybux, Skrill), and local internet banking. Deposits via these methods are credited instantly. Withdrawals to e-wallets (Mybux and Skrill) are instant while it takes up to 72 hours for bank accounts.

Trading Platforms and Support: The broker supports the MT4 and MT5 trading applications and a proprietary Trader (Exness Trader). You can access the platforms on the web, desktop or mobile devices. Customer support of Exness is available 24/7 via live chat and email for South African traders.

#3 HF Markets- Forex Broker with FSCA Regulation

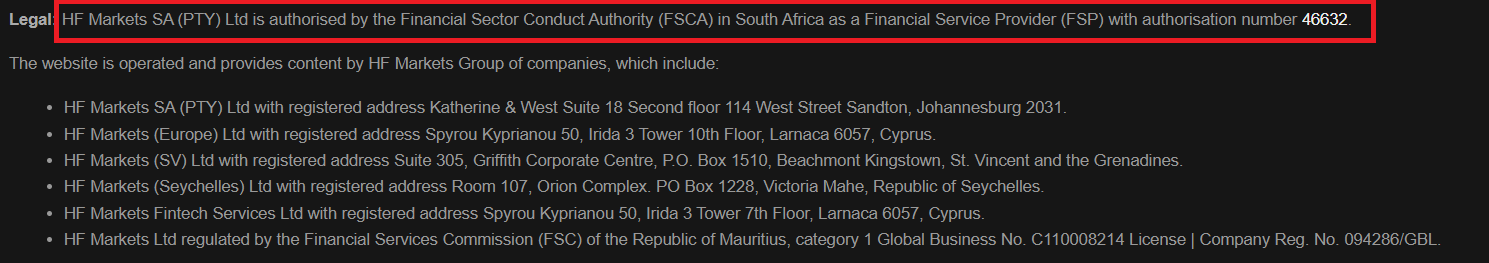

HF Markets is regulated in South Africa by FSCA as HF Markets SA (PTY) Ltd and licensed to offer Providers Services with Financial Services Provider number 46632, issued in 2016.

Account types: Account types offered by HF Markets are Cent, Zero, Pro, Pro Plus, Premium, and Top Bonus Account. The maximum leverage on HF Markets is 1:2000, which applies to forex pairs, other instruments have lower leverage limits. HF Markets offers negative balance protection for traders.

Fees: Trading fees charged by HF Markets are spreads, swap fees and commissions. HF Markets charges commission fees on forex only when using the Zero Account. Other Account types are commission-free.

HF Markets does not charge fees on deposits and all withdrawals are also free of charge, although the broker charges a monthly inactive account fee after 12 months of dormancy.

Tradable Instruments: You can trade CFDs on forex currencies pairs, indices, commodities (oil, metals, agriculture), cryptocurrencies, stocks, ETFs and bonds on HF Markets South Africa.

Deposits/Withdrawals: Payment methods supported on HF Markets are cards, e-wallets (Skrill) and online bank transfers. Deposits via these methods are credited within 10 minutes. Withdrawals made to bank accounts take about 1-3 working days to receive. It takes 24 hours to receive withdrawals to e-wallets and up to 10 business days for withdrawals to cards.

Trading Platforms and Support: The broker supports the MT4 and MT5 trading application and a proprietary trading application – HFM App and WebTrader. You can access the platforms on the web, desktop or mobile devices. HF Markets offers customer support to traders in South Africa via live chat, email and phone which is available 24/5.

#4 FXCM – FSCA Regulated Broker with Commission-free Trading

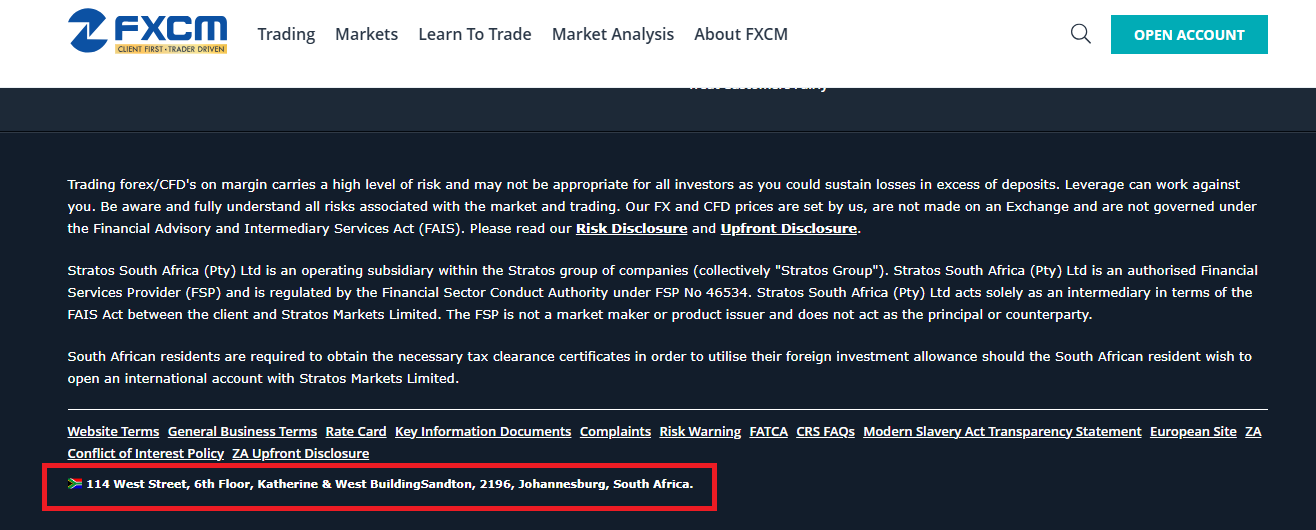

FXCM is regulated by FSCA as FXCM South Africa (Pty) Ltd and licensed to operate as Financial Services Provider (FSP) in South Africa with FSP No 46534, issued in 2016.

Account types: The 2 account types offered by FXCM in South Africa are Retail Account and Professional Accounts for more experienced traders. Accounts with retail status (which is the default) can trade with maximum leverage of 1:30. If you qualify for a Professional Account (professional client) you can trade with a leverage of up to 1:200. Your account can be classified as an Active Trader and you get some extra benefits. You can also apply for Islamic Account if you are a muslim and can prove it. FXCM offer negative balance protection for clients in South Africa.

Fees: FXCM fees include spreads and swap fees. While FXCM offers commission-free trading for all accounts, Active Trader Accounts are required to pay commissions on trades. The broker does not charge a fee for deposits, but withdrawals via bank wire transfers attract a fee of $40. If your account becomes dormant for 12 months, the broker charges an annual inactivity fee.

Tradable Instruments:Financial instruments on FXCM are CFDs on forex currency pairs, forex baskets, bonds, indices, indices baskets, stocks, stocks baskets, treasury (bond), commodities (oil, metals and agriculture), cryptocurrencies (for only professional clients) and precious metals pairs.

Deposits/Withdrawals:Payment methods supported for deposits and withdrawals on FXCM South Africa are e-wallets (Skrill, Neteller, etc), cards, and local bank transfer. Deposits can take 1 to 2 business days for bank transfer, 24 hours for cards and 1 business day for e-wallets. Withdrawals from FXCM can take 3 to 5 business days, depending on the payment method used.

Trading Platforms and Support: The broker supports the MT4 trading application and a proprietary ‘FXCM Trading Station’ which are available on the web, desktop and mobile devices (Android & iOS). FXCM offers 24/5 customer services to clients via live chat, email and local phone number.

#5 Tickmill – FSCA Regulated Broker with ZAR as Account Currency

Tickmill is registered in South Africa by FSCA as Tickmill South Africa (Pty) Ltd and licensed to offer Financial Services with FSP number 49464, issued in 2019.

Account types: You can open 3 account types on Tickmill in South Africa, which are Pro, Classic and VIP Accounts. All accounts have a maximum leverage of 1:500, which applies to major forex pairs and gold, other financial instruments have lower leverage limit. Negative balance protection is not guaranteed on Tickmill as the broker can choose not to clear a negative balance. This means that you may lose more than your deposits.

Fees: Tickmill charges spreads, commissions and swap fees. Classic Account users on Tickmill do not pay commissions on trades of certain instruments, including forex pairs. Tickmill offers free deposits and withdrawals. The broker does not charge any inactivity fee, however, any account that is dormant for more than 60 days and has less than $50 balance is disabled.

Tradable Instruments: Instruments you can trade on Tickmill are CFDs on forex currencies pairs, stocks indices, oil commodities, metals, cryptocurrencies and bonds.

Deposits/Withdrawals: IG Markets supports cards, internet bank transfers, crypto and e-wallets (Skrill, Neteller). While cards, crypto and e-wallets deposits are credited instantly, it takes about 2-7 business days for bank transfers. Withdrawals to cards take 1-8 business days and withdrawals to bank accounts are received within 1-7, while crypto and e-wallets take 1 business day.

Trading Platforms and Support: Tickmill supports MetaTrader 4 and 5, as well a proprietary Tickmill Mobile App. Tickmill offers customer support to traders via live chat, email and phone numbers in South Africa from 9AM to 10PM on business days.

Why choose a FSCA Regulated Forex Broker?

Choosing a FSCA-regulated forex broker in South Africa has some benefits. The FSCA regulation mandates forex brokers to protect your funds, ensure ethical practices, and offers clear channels for dispute resolution within South Africa in case you have an issue with a broker.

Forex brokers that are regulated in South Africa by FSCA are subject to strict oversight, which promotes a safer and more reliable trading environment. While forex trading always has some risk, FSCA regulation helps to minimize the risk associated with the forex broker practices.

Note that some forex brokers may be operating without regulation in South Africa, it is best to avoid such brokers as trading with them will be at your own risk with no protection from the Financial Sector Conduct Authority (FSCA).

How Does FSCA Protect You?

The Financial Sector Conduct Authority (FSCA) is the financial regulator to issue licenses to forex brokers and other businesses in the financial sector. The aim of FSCA is to protect investors and traders based in South Africa and ensure financial service providers treat them fairly. Here are some of the ways FSCA regulations protect forex traders in South Africa.

1) Segregation of funds: One of the FSCA rules for forex brokers is for them to keep clients’ funds in a separate account different from the account used for running the operations of the company or broker. This means that the money you deposit into your trading account for investment is not saved in the same account the broker uses for operations. This is to ensure the safety of clients’ funds and prevent the broker from using your money for day to day running of their business.

2) Complaints Handling: The FSCA provides a channel for traders to lodge complaints against forex brokers that are practicing something that is not fair to clients. You can submit complaints and FSCA will take appropriate action to investigate the situation and resolve it and may issue some sanctions against the broker or compel them to compensate the trader.

These are some of the benefits of trading with FSCA-regulated forex brokers in South Africa. In jurisdictions where forex is unregulated or the laws are not strict, traders tend to lose more morning.

How do you check if the broker is regulated by FSCA?

It is important to find out if a forex broker is regulated before you create an account and start using their platform.

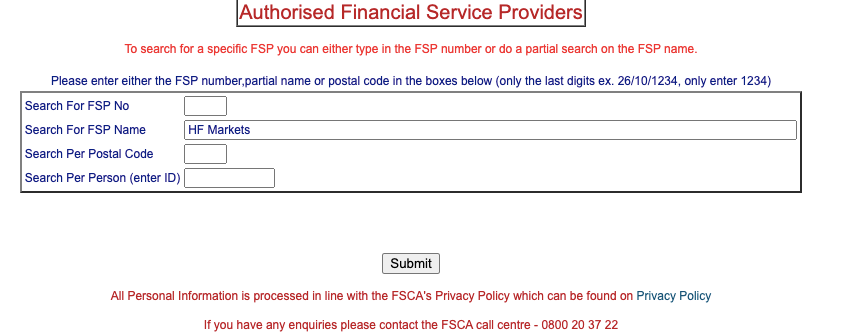

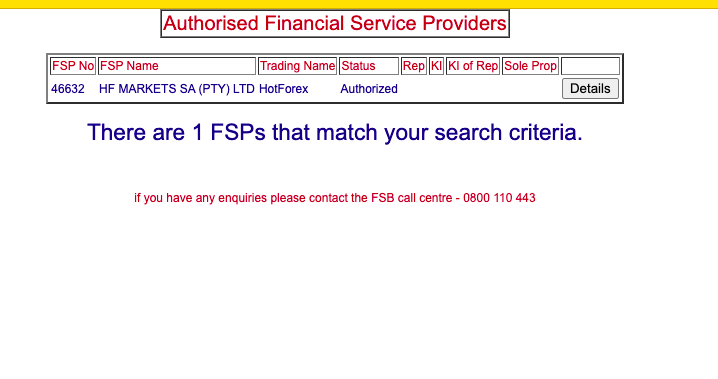

This is how to verify a forex broker’s FSCA regulation in simple steps. Let’s use HF Markets for the example:

Step 1) On the broker’s website, you should scroll to the bottom of the page to know if they are regulated by FSCA. All brokers usually state it. This is also important as their trading name may be different from the name they are regulated under. See an example with HF Markets below

Step 2) Go to the FSCA website at www.fsca.co.za/Fais/Search_FSP.htm.

Step 3) Type in the name of the broker, as seen on their website footer, in the search box and click ‘Submit’.

Step 4) The name of the broker will appear, and you can click on ‘Details’ to see more information about the broker such as the license date and approved products.

How to Manage Risks with Forex Trading

Forex trading involves risks and you could lose all your money, it is best that you avoid trading forex CFDs, unless you have experience and understand them.

In South Africa, the FSCA does not make it compulsory for forex brokers to offer negative balance protection, this means that you can lose more than the capital you invested and will be required to deposit additional money to clear the balance.

However, you can use the following strategies to manage the risks of trading:

1) Use lower leverage: While leverage can amplify profits, it can also increase your losses. It is advisable that you do not use all the leverage available to you, as this exposes you to more risks.

2) Use Stop Loss Orders: A stop-loss order automatically exits your trade position when the price reaches a level that you set, this helps to limit potential losses. Setting stop-loss orders helps to maintain discipline and prevents emotional trading decisions.

3) Position Sizing: Do not commit too much to a single trade. Allocate your capital in percentages for different trades, this ensures your account is diversified and can mitigate some risk if the market moves too fast against you.

4) Practice with a Demo Account: Ultimately, if you are starting out, before putting your real money and facing the risks, use demo accounts to learn more about the CFDs trading market and test your risk management strategies. This will allow you to experiment in a risk-free environment with risk-free virtual money.

5) Keep Learning and Stay Up-To-Date: The forex CFDs market is always changing due to several reasons and events. It is best to stay updated with recent economic news, central bank policies (of the currencies you are trading), and technical analysis techniques. This will help you to make informed decisions and change your risk management strategies as needed.

What is the FSCA’s leverage cap?

Forex brokers regulated with top-tier brokers like the FCA (UK) and ASIC (Australia) have a leverage cap of 30:1. This applies to retail traders. Brokers operating in the EU use the same leverage cap according to ESMA (European Securities and Markets Authority) rules.

The situation in South Africa is different. The FSCA does not impose a leverage cap on retail traders. However, you should choose a leverage level that aligns with your risk tolerance and trading capital.

Because there is no imposed cap, forex brokers in South Africa tend to offer retail traders leverage as high as 500:1. You will not find these levels for retail trading in top-tier regulated regions.

So, what should you do with high leverage? The answer is simple. Use leverage with caution, If there is an option of lower leverage, chose it.

Does the FSCA have any authority?

The FSCA is not a law enforcement agency. However, they have authority as a regulatory body. The FSCA is allowed to ensure compliance as far as forex trading is concerned. They are also allowed to sue entities that do not follow FSCA rules.

Here are some examples of those that have been punished by the FSCA:

Greyshore Investments (Pty) Ltd (2024): Greyshore Investments was a forex trading scheme ran by Ashley Mmachewe Mphaka. FSCA investigations concluded that Ashley solicited funds from the public with the promise to manage their trading accounts and/or trade on their behalf. She was slapped with a R2.1 million fine and a 20-year debarment.

IFX Brokers Holdings (Pty) Ltd (2023): IFX Brokers Holdings broke over-the-counter derivative provider (ODP) regulations.They offered CFD trading services to traders without a full ODP authorization. The company was fined R50,000.

What are the requirements for obtaining an FSCA license?

Registration:Under the Financial Advisory and Intermediary Services Act of 2002, all forex brokers must register as a Financial Services Provider (FSP). A category I FSP license allows forex brokers to offer forex pairs and other CFDs as derivatives.

Local presence:The FSCA requires brokers establish a legal entity in the country. This entity must have a physical office in South Africa. Forex brokers that meet this requirement usually have their South African office address on their website. It is usually at the footnote of the website. Here is an example from FXCM’s South Africa website.

The address is highlighted with the red box.

Key Personnel: Forex brokers must have a number of directors. At least one of them must be resident in South Africa. These directors must have a clean disciplinary record and possess relevant education and experience for their roles.

In addition, forex brokers must have compliance officers. Like the directors, at least one of the compliance officers must also be resident in South Africa.

KYC and AML Policies: Brokers are required to obtain know-your-client (KYC) data from their clients. Crucial questions must be asked to ensure that a client is ready to trade CFDs. Apart from names and address, documents that proof client identity and residence are also required.

Furthermore, client’s financial strength must also be strong enough to withstand losses common with CFD trading. There must also be a robust anti-money laundering (AML) policy.

Business Plan: Brokerage firms must provide a clear business that covers 3-5 years projections. It must also include marketing and operational models

Do FSCA regulated brokers support a ZAR Account?

Not all FSCA regulated brokers offer a ZAR Account. There are brokers regulated with the FSCA just so they can accept forex traders in South Africa. There is no FSCA regulation that makes offering a ZAR account compulsory.

Can I trade with a broker not regulated with the FSCA?

You do not have to trade with a broker licensed with the FSCA. Traders in South Africa can trade with any broker they want. However, we advise that you trade with tier-1 regulated brokers regardless of the jurisdiction.

How do I resolve issues with a regulate broker?

Every broker has a customer support team. You can reach out to them if you have any complaint. If the complaint is not solved and it is serious, you can lodge a complaint directly to the FSCA.

What is the FSB?

FSB means the Financial Services Board. It is the former name of the FSCA

FAQs on Best FSCA Regulated Forex Brokers

Is forex and CFD trading regulated in South Africa?

CFDs and Forex trading is regulated in South Africa by the Financial Sector Conduct Authority (FSCA). FSCA issues the Capital Markets Services license to forex brokers in South Africa.

Which brokers are registered with FSCA?

Plus500, HF Markets, Exness, Tickmill, and FXCM, among others are forex brokers licensed by FSCA in South Africa.

How do I trade FX in South Africa?

To trade FX in South Africa, you have to create a trading account with any of the regulated forex brokers in South Africa. Some of them are Plus500, HF Markets, Exness, etc.

Do FSCA-regulated brokers offer Islamic accounts?

Yes, brokers regulated in South Africa by FSCA offer Islamic Accounts. Exness, HF Markets, and Tickmill are some of the forex brokers that offer Islamic Accounts to traders, such accounts are usually swap-free for a specific period.