FBS is an online Forex and CFDs broker offering trading services for financial markets such as foreign exchange (forex) currency pairs, indices, cryptocurrencies, metals, stocks and commodities.

FBS was founded in 2009. The broker is regulated in South Africa, Australia, Cyprus and Belize.

This review of FBS will examine the fees, trading instruments, account opening process, customer support, deposit/withdrawal options and trading platforms offered by the broker.

| FBS Review Summary | |

|---|---|

| 🏢 Broker Name | Trade Stone SA (Pty) Ltd. |

| 📅 Establishment Date | 2009 |

| 🌐 Website | www.fbs.com |

| 🏢 Address | FBS Markets Inc, 2118, Guava Street, Belize Belama Phase 1, Belize |

| 🏦 Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 1:3,000 |

| 📋 Regulation | FSCA, FSC Belize, ASIC, CySEC |

| 💻 Trading Platforms | MT4, MT5 and FBS Trader available on PC, Mac, Web, Android, & iOS |

| Visit FBS | |

FBS Pros

- Regulated in South Africa

- Offers commission-free trading

- Has 24/7 live chat support

- Supports multiple trading platforms

- Does not charge dormant account fees

- Has negative balance protection for all accounts

FBS Cons

- Few tradable instruments available

- Has high leverage

- South Africans are registered under an offshore regulation

- Charges withdrawal fees on all payment methods

Is FBS a legit broker?

FBS is the trading name of the FBS brand which is licensed in various countries by Top-Tier financial regulators under different names, including South Africa. The multiple regulations of FBS make them a legit broker for traders in South Africa.

Here are the various jurisdictions in which FBS is authorised:

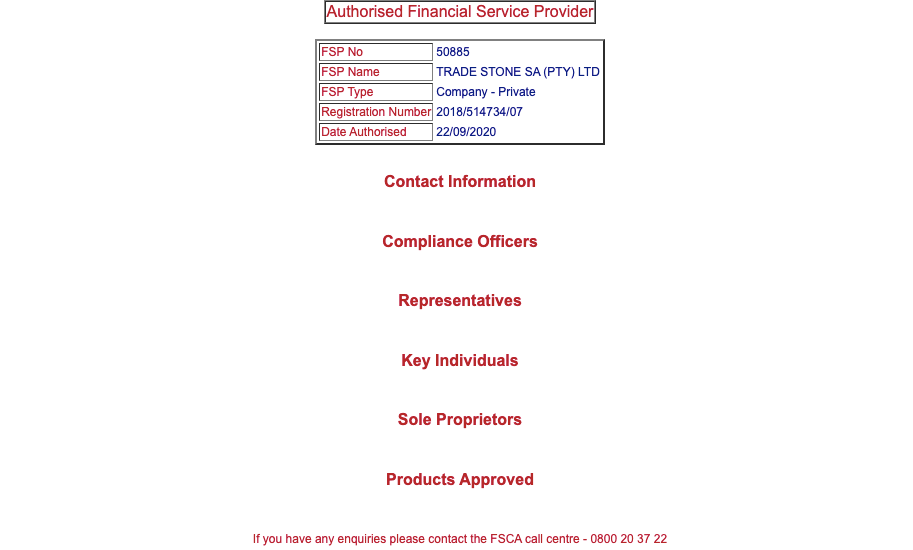

1) Financial Sector Conduct Authority (FSCA), South Africa: FBS is regulated in South Africa by FSCA as ‘Trade Stone SA (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 50885, issued in 2020.

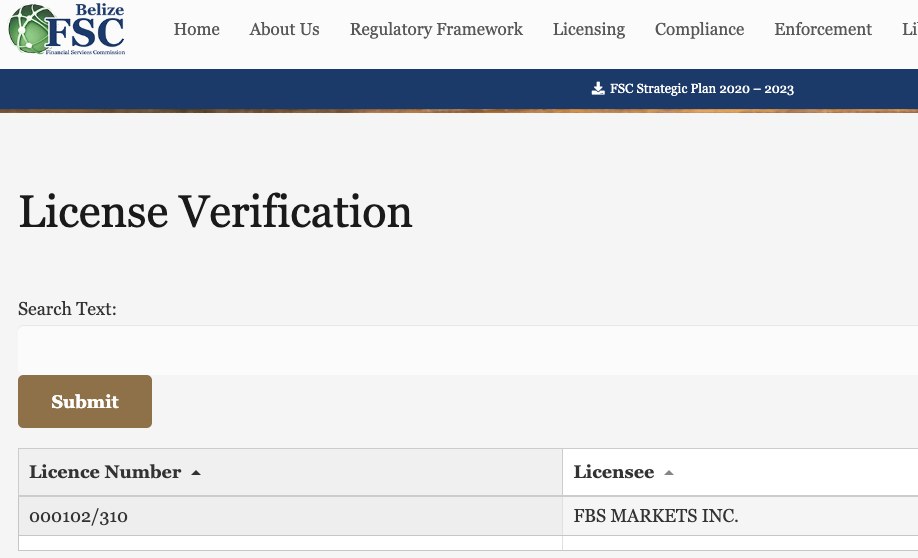

2) Financial Services Commission (FSC), Belize: FBS is also licensed in Belize as ‘FBS Markets Inc.’ with license number 000102/310. Although FBS is authorised in South Africa, traders in South Africa are registered under this regulation.

Note that it is best to trade with a broker that registers South African traders under the FSCA regulation. This is because with offshore regulation, the consumer protection of the foreign countries may not cover traders from South Africa. Trading with this broker is at your own risk.

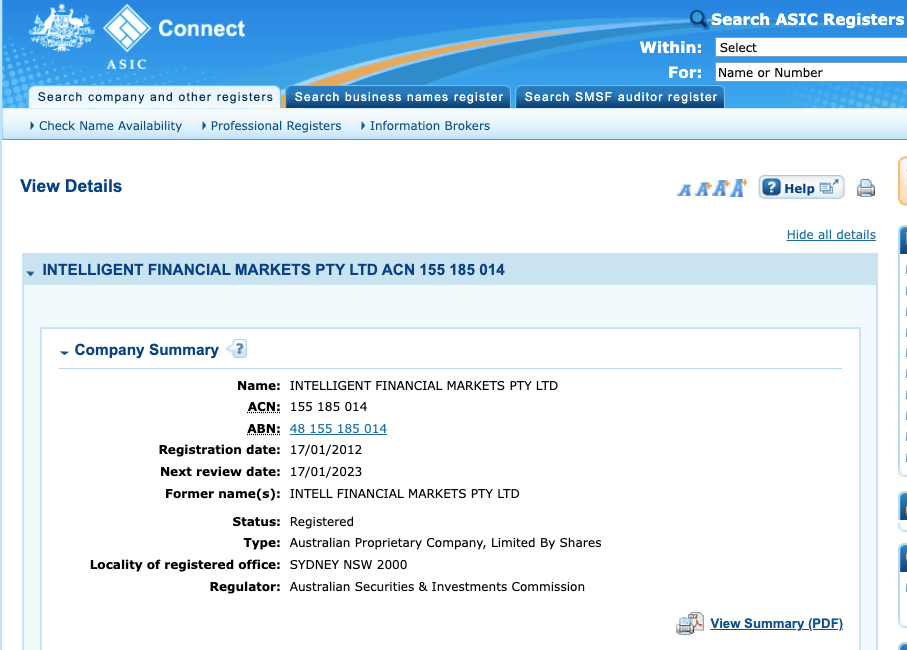

3) Australian Securities & Investments Commission (ASIC): FBS is regulated in Australia by ASIC as ‘Intelligent Financial Markets Pty Ltd’, and licensed to offer financial services, with ACN (Australia Company Number) 155 185 014, issued in 2012. The broker uses ‘FBS Oceania’ as a trading name in Australia.

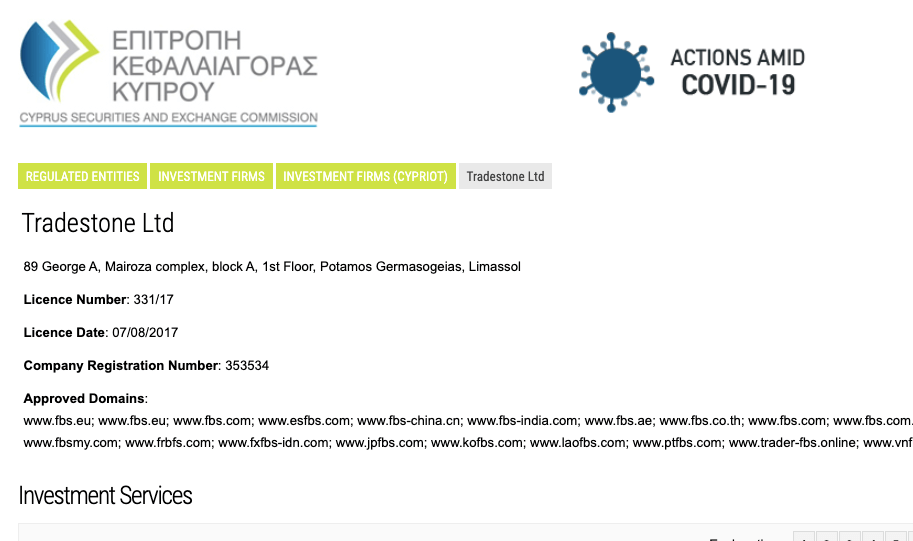

4) Cyprus Securities and Exchange Commission (CySEC): FBS is regulated in Europe by CySEC and licensed to offer investment services under the name ‘Tradestone Ltd’, with license number 331/17, issued in 2017. FBS serves clients in the EU area through this license.

FBS Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| South Africa | No fixed compensation | Financial Sector Conduct Authority (FSCA), South Africa | Trade Stone SA (Pty) Ltd |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Intelligent Financial Markets Pty Ltd |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Tradestone Ltd |

| Malaysia | No protection | Financial Services Commission (FSC), Belize | FBS Markets Inc. |

FBS Leverage

The leverage on FBS depends on the account type you have and the instrument you are trading. The maximum leverage on FBS is 1:3000, which applies to the Standard Account.

The maximum amount applies to major forex pairs, other instruments have lower leverage limits.

With the leverage of 1:1000, you can open a trade position worth 1,000 times your deposit. For example, if you deposit $100 you can place a trade worth $100,000.

It is important that you do not use high leverage in your trade as it increases your risk and you can lose your money. Leveraged products trading involves risk and you should not trade them unless you understand them and have experience.

FBS Account Types

FBS offers one account type, the Standard Account, which combines the features of the previous 3 account types. You can request an Islamic Account or open a demo account on FBS to practice trading with virtual money before putting your real money.

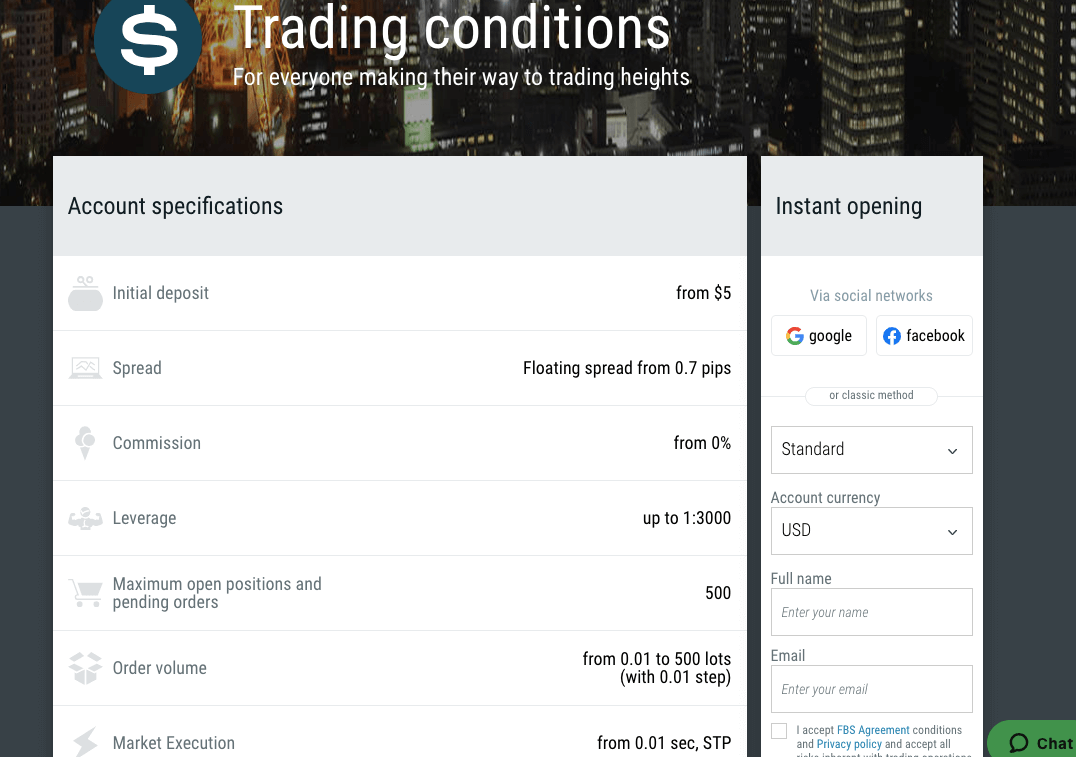

Here is an overview of the trading account conditions on FBS.

1) Standard Account: The FBS Standard Account is designed for more experienced traders who trade large lots of instruments and is accessible on the MT4 and MT5 trading platforms.

This is the default account you get when you first sign up on FBS, it allows you to trade, forex pairs, forex exotics, indices, metals, energies and stocks. and you can also open a demo version of this account type for practice.

This account has floating spreads starting from 0.7 pips, you do not pay commission charges for opening and closing trade positions, but pay swap fees if you keep a trade position open past the market’s closing time.

This account requires a minimum deposit of $5, with a minimum trade size of 0.01 lots and maximum open positions of 500, with maximum leverage of 1:3000 for major forex. This account also has negative balance protection.

This account has negative balance protection, which means that if a trade position is unsuccessful and you make a loss, any negative balance on your account will be reset to zero and you don’t have to deposit additional funds to clear it.

2) Islamic Account: FBS offers Swap-free Islamic Accounts to traders in South Africa. The account is designed for Muslim traders who want to abide by the sharia law of no-riba.

You can convert any account type to an Islamic status. To activate swap free for your account you should send a request:

1) The copy of your identity document you used for verification of your account.

2) The account number you want to activate Swap Free option for.

You can send a request to [email protected] to activate the swap free status.

The swap-free account on FBS does not charge any swap fees or interest for keeping a trade position open past the market’s closing time.

If you keep a position open for more than 2 days, the broker may charge a fixed fee for the number of days the trade position remained open.

The Swap Free option is available for all trading instruments; however, when trading Forex Exotic, you will be charged a commission once a week instead of the swap.

FBS Base Account Currency

FBS offers 2 account base currencies for you to choose from when creating an account on the platform. They are Euros – EUR and United States Dollars – USD.

All your deposits, trades, profits, losses, and withdrawals are measured in your chosen account currency.

Although FBS currently does not have South African Rand (ZAR) as account currency, you can deposit in ZAR and it will be converted to the base currency of your account.

FBS Overall Fees

Fees on FBS South Africa depend on the account type you have, and the instrument you are trading. Find a summary of the trading and non-trading fees on FBS below:

Trading fees

1) Spread: Whenever you trade an instrument on FBS, the broker adds a markup to the market (ask) price of the instrument. This markup is called spread, it is the difference between the ask (sell) price and bid (buy) price of financial instruments and is measured in pips.

The spreads you pay on FBS depend on your account type, the instrument you are trading, and the size of your trade. Find the typical spread you will pay for major instrument pairs on FBS South Africa per standard lot (trade size of 100,000 units) below:

2) Commission fees: FBS does not charge commission fees on trades. The FBS offers commission-free trading on all accounts.

FBS Trading fees Table

Here is a summary of the typical fees (minimum spread and commission) FBS charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 0.9 pips | None |

| GBP/USD | 1.0 pips | None |

| EUR/GBP | 1.6 pips | None |

| (XAUUSD) Gold | 0.23 pips | None |

| Oil(Brent) | 0.03 pips | None |

| UK100 | 1.8 pips | None |

| US30 | 3.0 pips | None |

3) Swap fees: The closing time of the market on FBS is 11:59 PM trading platform time, if you keep a trade position open past the closing time, the trade will roll over to the next day and you will incur overnight funding costs also called rollover fees or swap fees.

The swap fees will depend on the instrument you are trading, the size of the trade, the spread, leverage, and whether your trade position is a long swap (buy) or short swap (sell). Islamic Accounts do not pay swap fees, because they are swap-free.

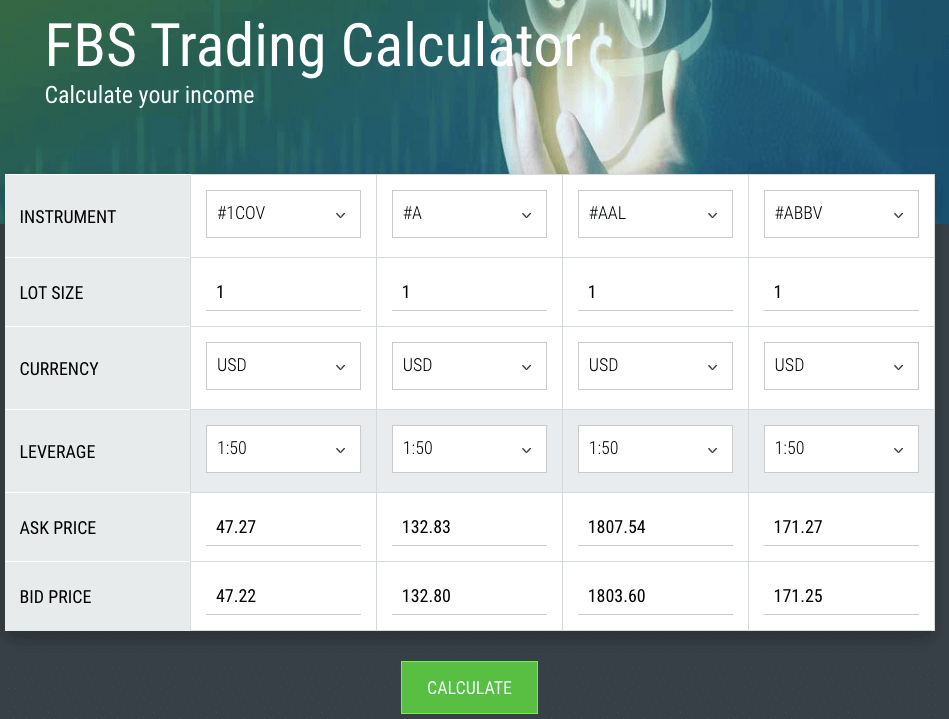

You can use the Trader’s Calculator on the FBS website to calculate the likely swap fees you will pay on a trade.

1) Deposit and Withdrawal fees: FBS offers free deposit on all payment methods when you deposit above the minimum deposit, except for STICPAY which attracts a deposit fee of 2.5% plus US$0.3.

Withdrawal fees on FBS are $1 per transaction for cards, 2% for Neteller capped at $30, 2.5% plus US$0.3 for STICPAY, 1% plus $0.32 for Skrill, and 0.5% for PerfectMoney, while bank transfer withdrawal charges can be seen when you are about to withdraw on the portal, based on the amount.

2) Account Inactivity charges: FBS does not charge inactive account fees. If you do not log in to your account or do not perform any trade, no fees will be incurred, and any funds in your account will not be touched.

FBS Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free |

| Withdrawal fee | 2.5% per transaction for e-Wallets, $1 for cards |

*Note that your payment processing company may charge some independent transaction fee.

How to Open FBS Account in South Africa?

Follow these steps to open a trading account on FBS.

Step 1) Go to the FBS website at www.fbs.com and click on the ‘OPEN ACCOUNT’ button highlighted in red.

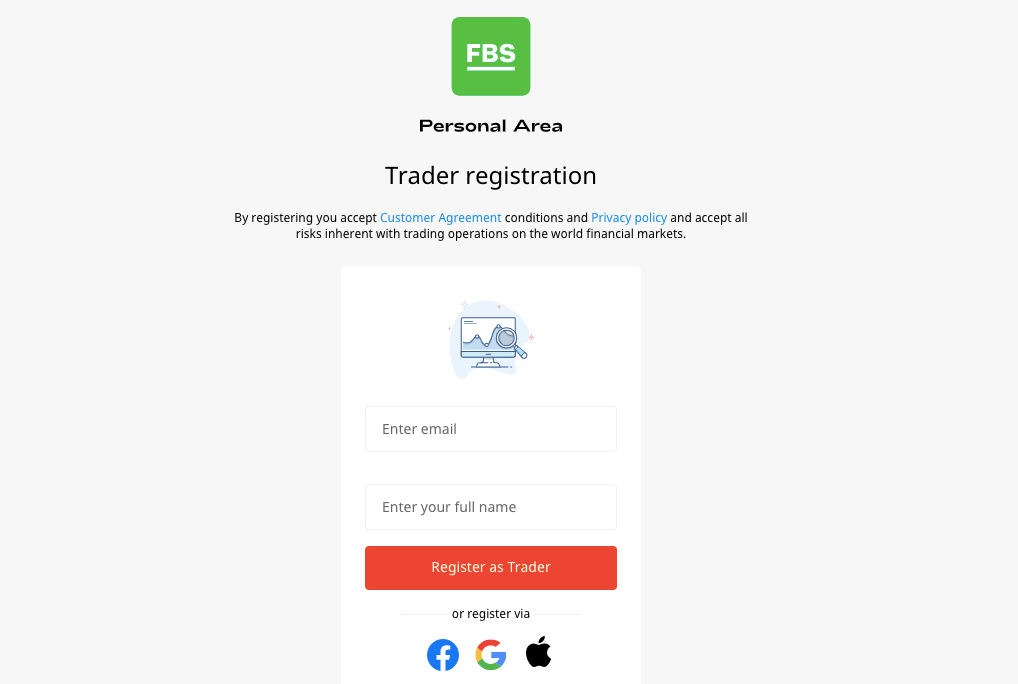

Step 2) Enter your full name and email on the form that appears, then click ‘Register as Trader’.

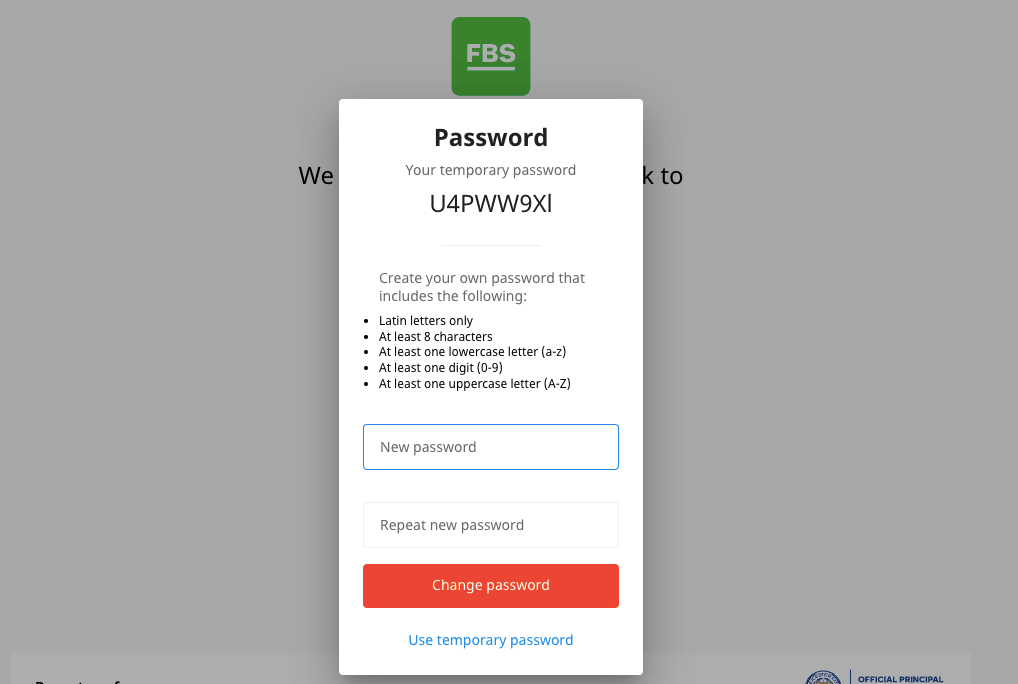

Step 3) Create a password for your account and click ‘Change password’, then go to your email inbox and click the verification link sent.

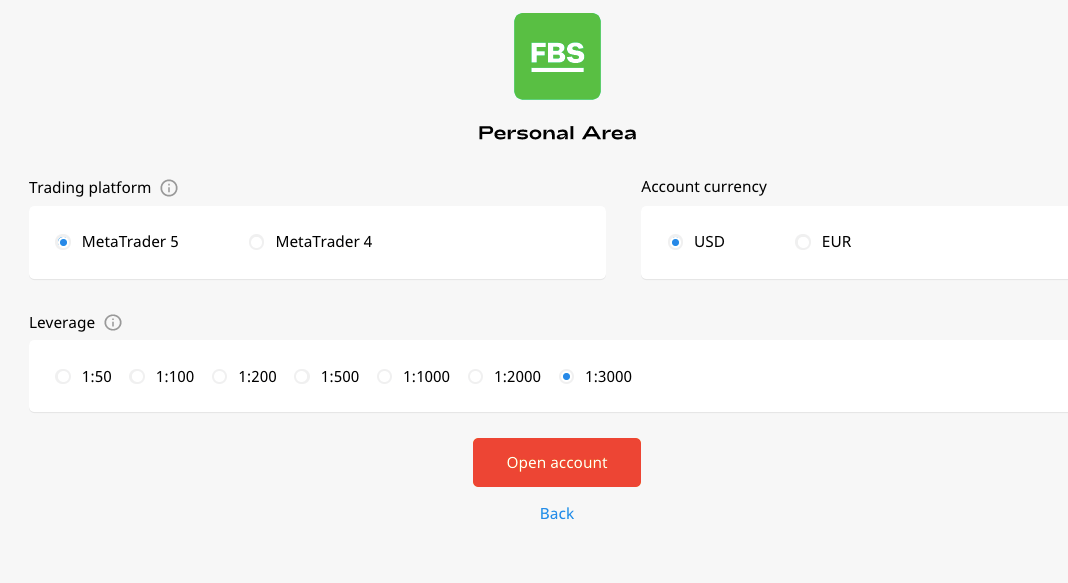

Step 4) After confirming your email, click ‘Open account’ on the page that appears, choose your preferred trading platform (MT4 or MT5), account currency and set your desired maximum leverage, then click ‘Open account’.

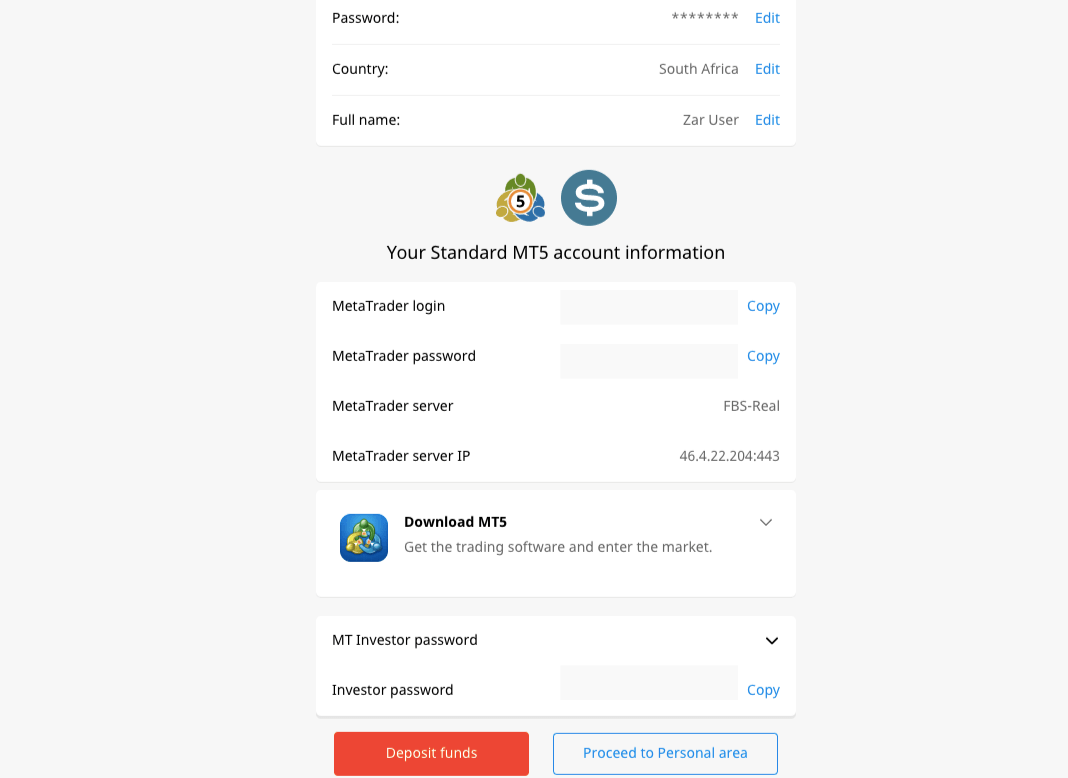

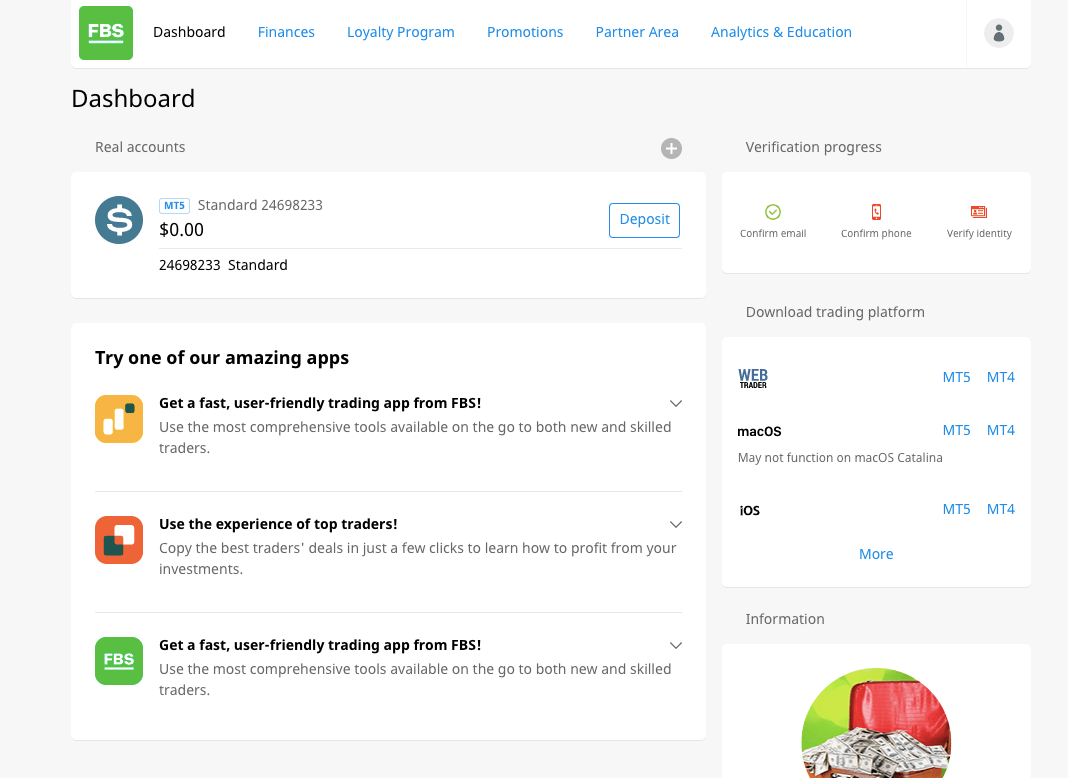

Step 5) Confirm the information you have supplied and click ‘Proceed to Personal area’, and you will be redirected to your FBS dashboard.

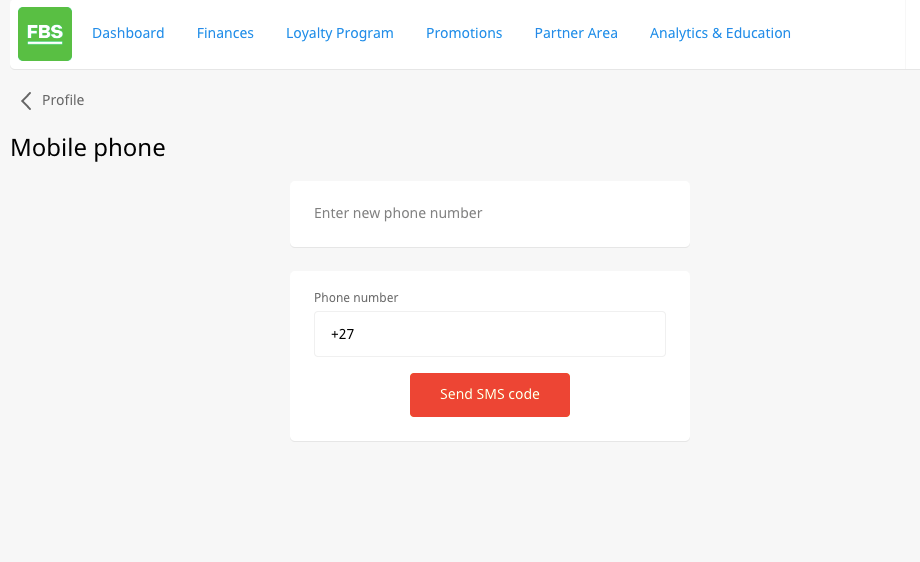

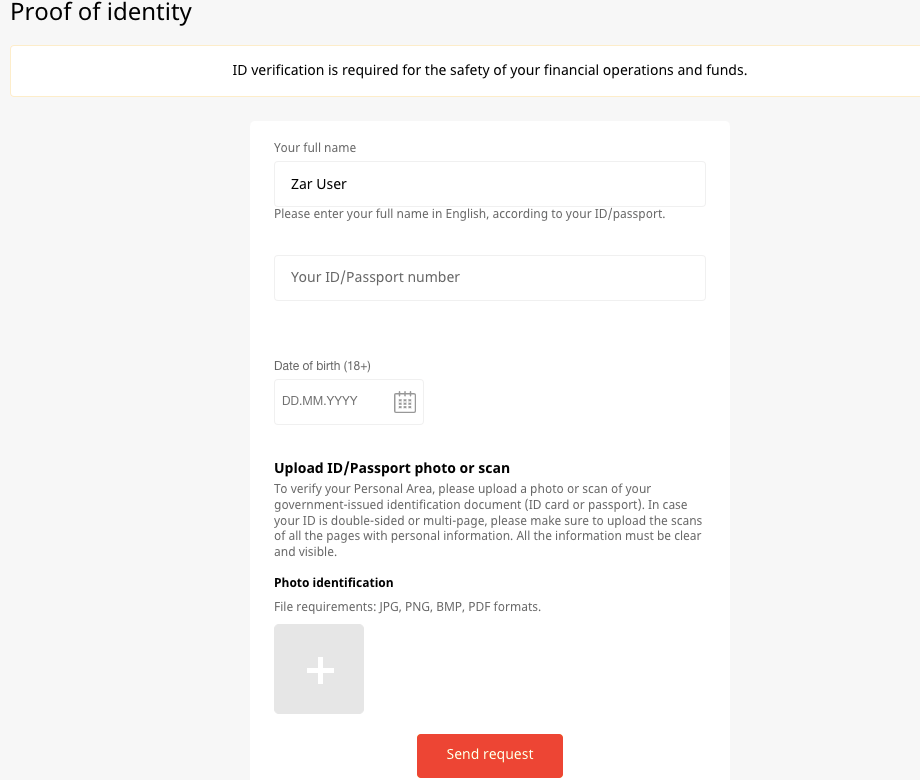

Step 6) To verify your account on the dashboard, you will be required to provide a phone number and some identity and address documents like a government-issued ID card and a utility bill or bank statement.

FBS Deposits & Withdrawals

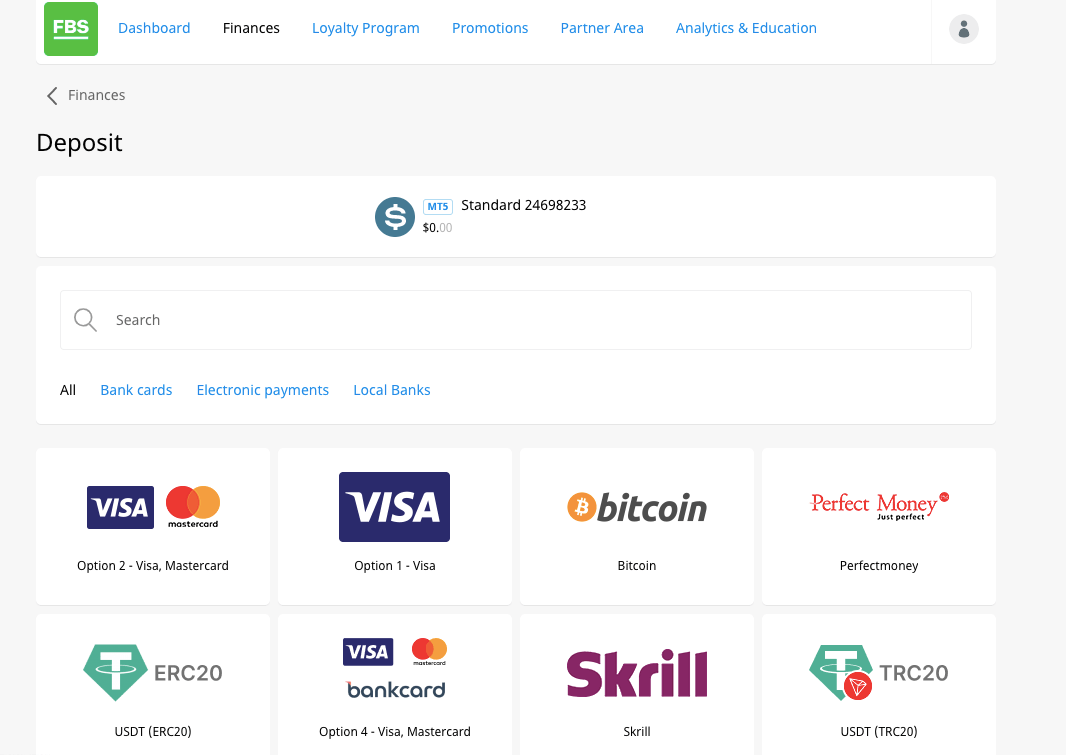

Payment methods supported by FBS for deposits and withdrawals are bank transfers (local and international), cards, and e-wallets (Skrill, Neteller, Sticpay, PerfectMoney). The account/card used for deposit and withdrawal must have the same name as the one on your FBS trading account.

Here is the summary of the deposits and withdrawals options on FBS South Africa.

FBS Deposit Methods

Here is a summary of payment methods accepted by FBS for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Wire Transfer | Yes | Free | 20 minutes to 48 hours |

| Cards | Yes | Free | Instantly |

| E-wallets | Yes, (Neteller, Skrill, etc) | 2.5% + $0.3 per transaction on SticPay | Instantly |

FBS Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FBS.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Wire Transfer | Yes | Depends on the amount of withdrawal, fee can be seen on withdrawal page. | 1-3 business days |

| Cards | Yes | $1 per transaction | 2-7 business days |

| E-wallets | Yes, (Neteller, Skrill, etc) | 2.5% + $0.3 for SticPay, 2% for Neteller with a mininum of $1 & max. of $30, 1% + $0.32 for Skrill, 0.5% for PerfectMOney | 20 minutes to 48 hours |

What is the minimum deposit for FBS?

The minimum deposit on FBS depends on your account type and the payment method you are using. While the general FBS minimum deposit is $1, bank transfer requires a minimum of R100, cards require $3 and $10 for e-wallets.

Pro Accounts require a minimum deposit of $200, Standard and Cent Accounts require a minimum deposit amount of $1.

How do I deposit money into FBS?

Follow these steps to add money to your FBS account

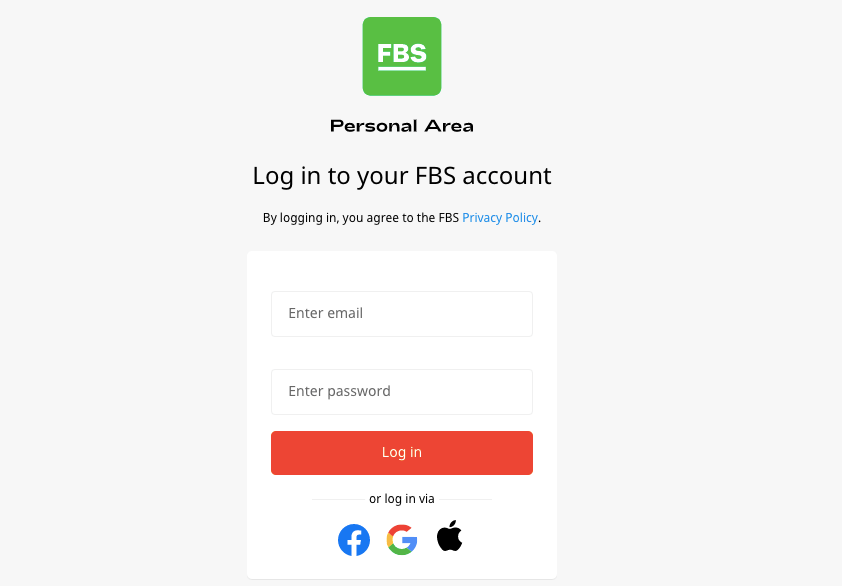

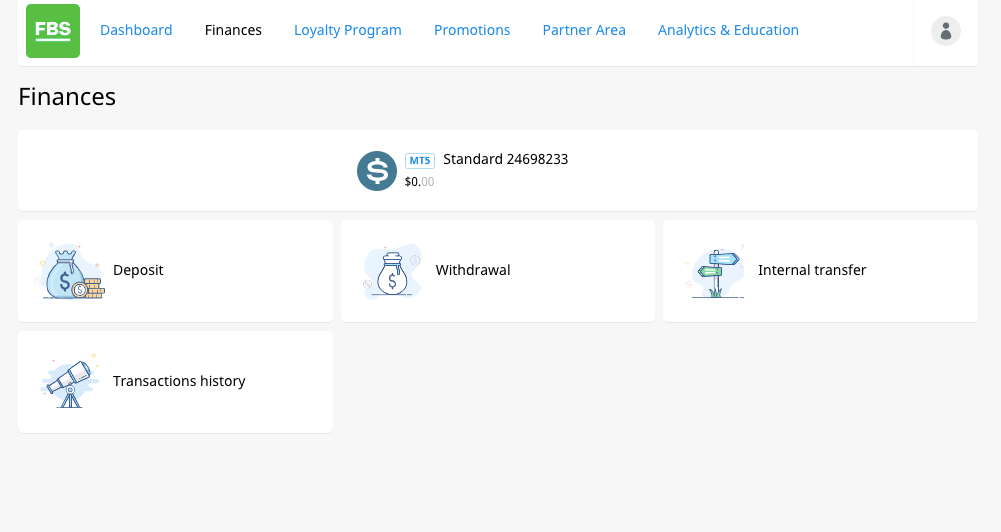

Step 1) Log into your FBS dashboard via www.fbs.com/cabinet/login

Step 2) Click the ‘Finance’ tap on the dashboard, then select ‘Deposit’ and choose the payment method you want to use.

Step 3) Enter the amount you want to add, click the ‘Deposit’ button and follow the on-screen instructions to complete your deposit.

What is FBS Minimum withdrawal?

The minimum withdrawal amount on FBS varies depending on the payment method you are using, although it starts from $1.

How much can I withdraw money from FBS?

To withdraw funds from Trade Nation, follow these steps.

Step 1) Log into your FBS dashboard via www.fbs.com/cabinet/login

Step 2) Click ‘Finance’ on the dashboard, then ‘Withdraw’ and choose the payment method you want to use.

Step 3) Enter the amount you want to withdraw and follow the on-screen instructions to complete your withdrawal.

FBS Trading Instruments

You can trade the following financial instruments on FBS:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 72 currency pairs on FBS (28 majors and 44 Forex Exotics) |

| Commodities CFDs | Yes | 3 spot Energies on FBS (Brent, Crude, NatGas) |

| Metals CFDs | Yes | 8 pairs of Metals on FBS (Gold, Palladium and Silver paired to USD and EUR) |

| Indices CFDs | Yes | 11 spot indices on FBS (AU200, UK100, US30, and others) |

| Stocks CFDs | Yes | 127 stocks on FBS (US stocks) |

FBS Trading Platforms

Trading platforms supported by FBS are:

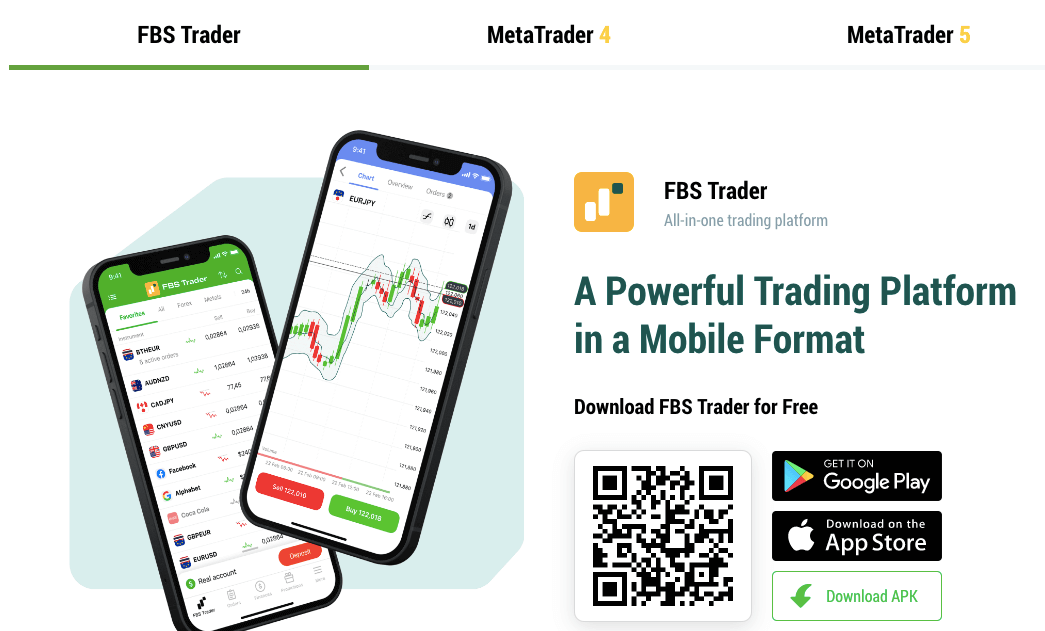

1) MetaTrader 4 and MetaTrader 5: FBS supports the MT4 and MT5 trading applications as platforms for trading the financial markets. You can access the platform via the web, and download it on desktop (Windows and Mac) and on mobile devices (iOS and Android).

2) FBS Trader: The FBS Trader is a proprietary trading platform developed by FBS and is available on mobile devices only. You can download it from the Apple App Store or Google Play Store.

FBS Trading Tools

FBS has some trading tools that you can use alongside the trading platform, they are:

1. FBS Economic Calendar: The FBS Economic Calendar Feature helps you keep tabs on important economic events. The built-in Economic Calendar is like a friendly fortune teller for the markets, highlighting key dates like interest rate changes, inflation reports, and job data.

Remember, these events can cause currencies to jump or dive, so being prepared is key! FBS’s calendar help you know what’s coming up and can potentially plan your trades accordingly.

2. FBS Trader’s Calculator: The FBS Trader’s Calculator is a built feature you can access on the FBS website in Australia. You can use it to know how much you could win or lose on a trade. You can also use the calculator to check your margin requirements or the value of each pip movement. You can also access the calculator on their website under the Tools section.

3. FBS Currency Converter: The FBS Currency Converter is your instant translator when trading different currencies. It shows you the exact exchange rate between any two currencies in a flash. Whether you’re dealing with euros, yen, or something else entirely, this tool takes the guesswork out of international trades. It helps you know exactly how much you’re getting and can make sure you are securing the best deals.

FBS Promotions

FBS offers a number of promotions to traders in South Africa, registered under FBS Markets Inc, regulated in Belize. Find a summary of various FBS bonuses below:

- 100% Deposit Bonus: This bonus is offered to new traders on their first deposits. You get double the amount you deposit, you can use it to trade and withdraw the profits.

Cashback: FBS rewards traders with cash rebates on trades of up to $15 per lot traded. You can withdraw this cashback or use it to trade and then withdraw the profits. FBS Loyalty Program: This is an FBS promotion in which you signup as a partner on the Loyalty Program on your Personal Area, and you earn points when you trade or invite other clients to join the platforms. You can then convert your points to real items, like phones, company merch, and cars among other.

Note that you will have to activate these bonuses in your Personal Area to enjoy them. Also, check the Terms and Conditions to be sure you want to activate the bonus on FBS. You can also check out the broker’s website for other bonuses.

FBS South Africa Customer Service

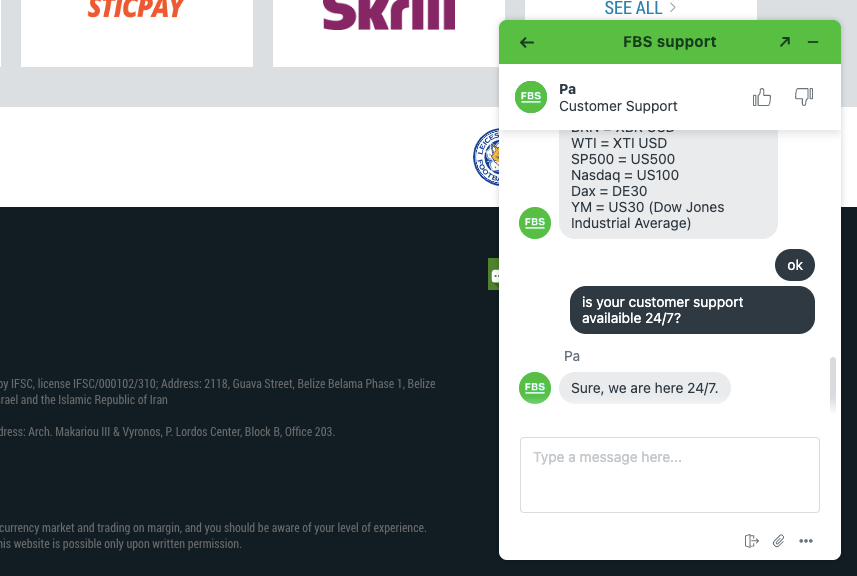

FBS offers 24/7 customer support to traders via the following channels:

1) Live chat support: The FBS live chat is available 24 hours every day and can be accessed on the broker’s website.

When you first initiate the chat, a chatbot will suggest likely answers in articles to you. Click on ‘Get in touch’ to transfer to a live agent. You will be required to submit your email and name to start the chat.

When our team tested the live chat on the FBS website, the wait time was under 2 minutes before a live agent responded to our chat and the answers to our questions were relevant and prompt.

2) Email support: FBS offers email support to clients in South Africa. The email is available 24/7 as well. We sent an enquiry to the FBS email support and got an auto-response acknowledging receipt of our enquiry but no live agent replied after several hours. The FBS email address for enquiries in South Africa is [email protected].

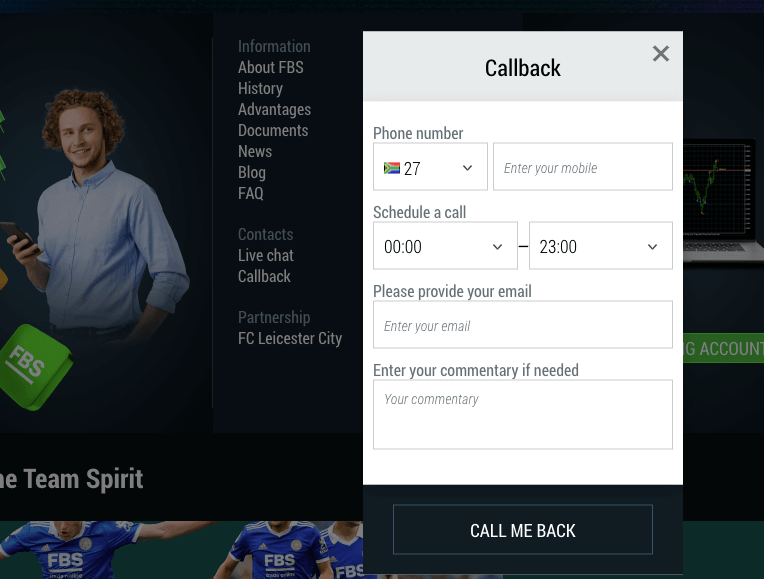

2) Phone support: FBS does not offer phone line supports to clients in South Africa, although you can request a call back from the support team via live chat by providing your phone number and the customer support representative will call you within 7 days. You can also reach them on WhatsApp via this FBS phone number +7 904 556-52-42.

Does FBS Allow Scalping?

Yes, FBS permits Scalping. FBS is an Electronic Communication Network (ECN) broker, which implies that they connect buyers and sellers using electronic communication networks. This feature enables them to offer a tight spread and fast execution speed.

To commence scalping on FBS, they suggest using the ECN account available on MT4. However, it’s essential to remember that scalping is risky, and you must have robust risk management strategies to avoid or mitigate losses.

Do we Recommend FBS South Africa?

FBS is regulated in South Africa by FSCA and other Tier-1 and Tier-2 financial regulators. This means the broker is obliged to protect clients’ funds. FBS also offers negative balance protection for all clients.

A downside to the broker is that South African traders are registered under the regulation in Belize, which means you cannot lay claims to the regulated company in South Africa. They do not offer ZAR as account currency too.

The fees on the platform are moderate as they offer commission-free trading on 3 accounts and competitive spreads, and zero inactive account fees, although the broker charges withdrawal fees on all payment methods.

FBS offers a variety of account types to choose from, including demo and Islamic Accounts. This means both beginners and expert traders can sign up on the platform and find an account that is right for them. Although they offer few tradable instruments.

FBS customer support is fair, as they respond fast to enquiries via live chat alone and it is available 24/7.

We recommend that you try FBS after reviewing the instruments available on the platform to be sure they have the assets you want to trade. Otherwise, there are other brokers regulated in South Africa that have more instruments with friendly features too, including a ZAR account currency.

FBS South Africa FAQs

What is the minimum deposit on FBS?

The minimum deposit on FBS is $1 for the Cent Account, while other account types have higher minimum deposits, some payment methods like e-wallets require a minimum deposit of $10 and 100 ZAR for local bank transfers in South Africa.

Is FBS regulated in South Africa?

FBS is regulated in South Africa by FSCA (Financial Services Conduct Authority) as ‘Trade Stone SA (Pty) Ltd’ and authorized to provide financial services in 2020.

How long does FBS withdrawal take?

FBS withdrawal takes about 20 minutes to 48 hours for e-wallets, 2-7 days for cads, and 1-3 business days for bank transfers.

Does FBS take commission?

FBS charges commission starts from 0%.

Is FBS bonus withdrawable?

Depending on the bonus type, you can withdraw bonus from FBS and the profits realised from the bonus, after meeting the required trade lot volume which is indicated on the terms and conditions of the bonus.

Note: Your capital is at risk