FXCM is a Forex and CFDs broker offering CFDs trading services. You can trade currencies, commodities and shares on the FXCM platform. FXCM was established in 1999, is regulated by FSCA, FCA, CySEC and ASIC, and has offices in the UK, Australia, South Africa and Cyprus.

In our review of FXCM, we examine the safety of funds with the broker, deposit/withdrawal options, fees, account types, opening account process, leverage information, tradeable instruments and trading conditions.

| FXCM Review Summary | |

|---|---|

| 🏢 Broker Name | FXCM South Africa (Pty) Ltd |

| 📅 Establishment Date | 1999 |

| 🌐 Website | www.fxcm.com |

| 🏢 Address | FXCM South Africa (Pty) Ltd, 114 West Street, 6th Floor, Katherine & West Building Sandton, 2196, Johannesburg, South Africa |

| 🏦 Minimum Deposit | $50 (ZAR 900) |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | FSCA, FCA, ASIC, CySEC |

| 💻 Trading Platforms | MT4, FXCM Trading Station, TradingView Pro, and Capitalise AI available on PC, Mac, Web, Android, & iOS |

| Visit FXCM | |

FXCM Pros

- Regulated in South Africa

- Fast processing of deposits

- Offers commission-free trading

- Supports multiple trading platforms

- User-friendly website

FXCM Cons

- Does not offer 24/7 customer support

- Charges dormant account fees after 1 year

- Has few tradeable instruments

- Charges withdrawal fees for wire transfer

- Does not have ZAR account currency

Can FXCM be trusted?

FXCM is the trading name of Forex Capital Markets, a company owned by Leucadia Investments/Jefferies Financial Group.

The FXCM Group is regulated in various jurisdictions under different names. Find a list of the regulations of FXCM below:

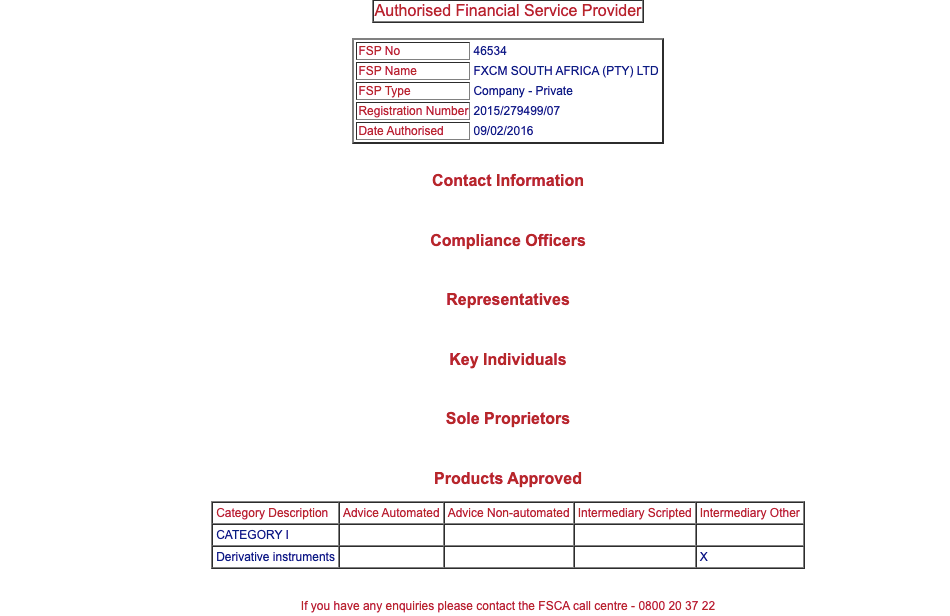

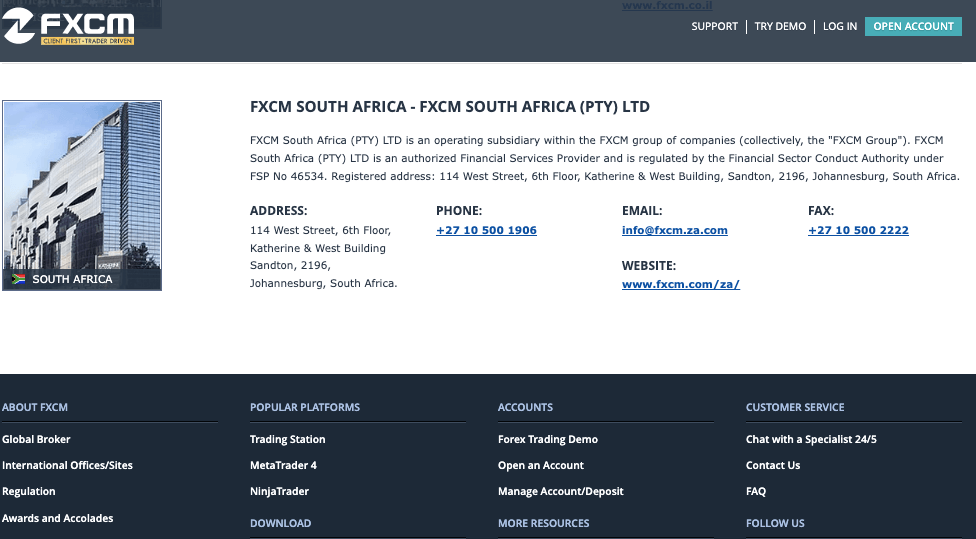

1) Financial Sector Conduct Authority (FSCA), South Africa: FXCM is regulated in South Africa by FSCA as ‘FXCM South Africa (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 46534, issued in 2016.

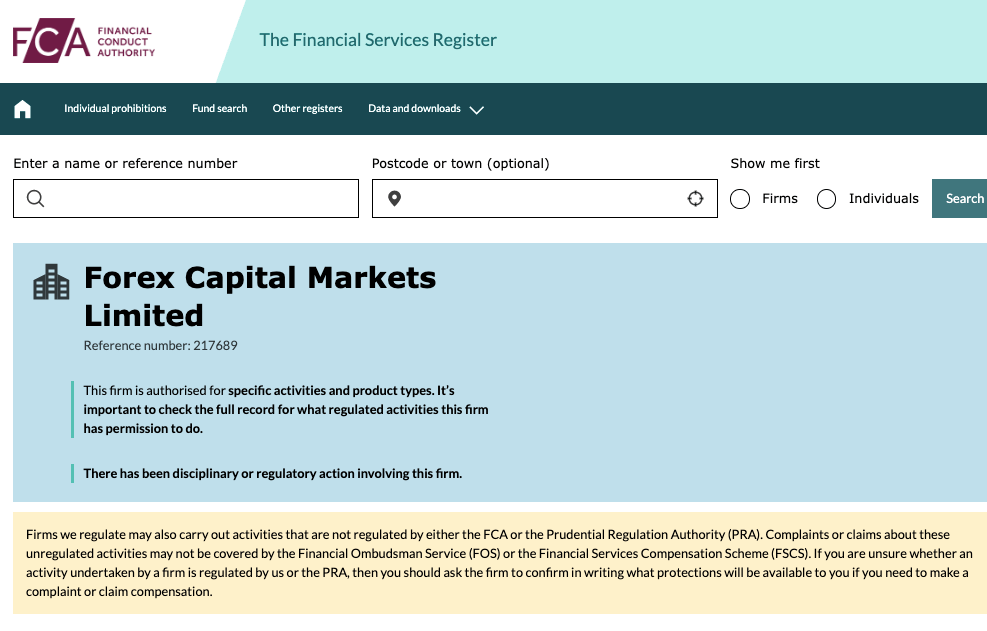

2) Financial Conduct Authority (FCA): FXCM is regulated by the FCA as ‘Forex Capital Markets Limited’ and authorized to offer financial services in the UK, with reference number 217689, issued in 2003.

Although FXCM is regulated in South Africa by FSCA, traders in SA are registered under this regulation. Bear in mind that trading with this broker may mean trading at your own risk as the foreign regulation may not cover South African traders.

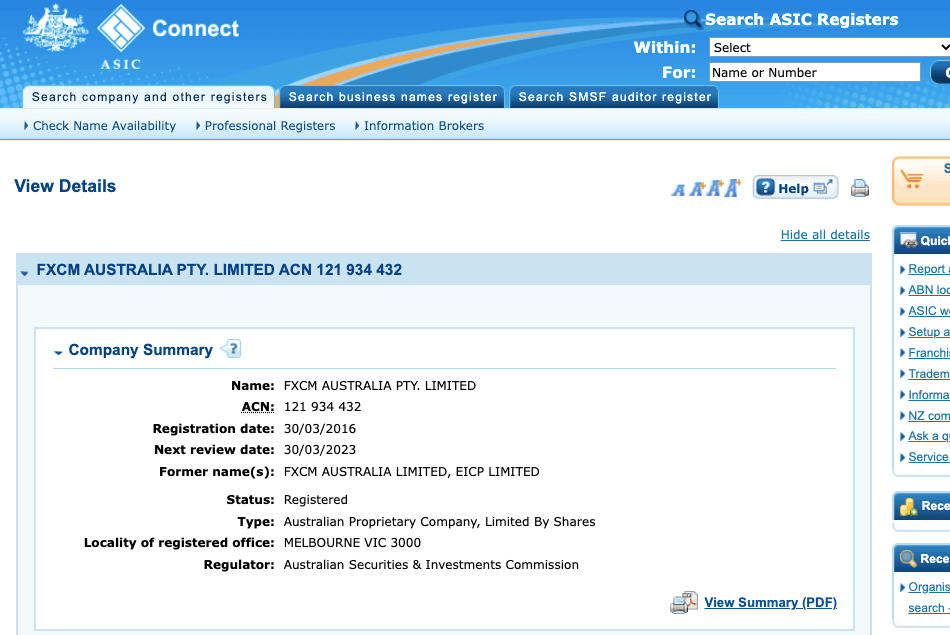

3) Australian Securities & Investments Commission (ASIC): FXCM is regulated in Australia by the ASIC as ‘FXCM Australia Pty. Limited’ and licensed to offer financial services, with ACN (Australia Company Number) 121 934 432, issued in 2016.

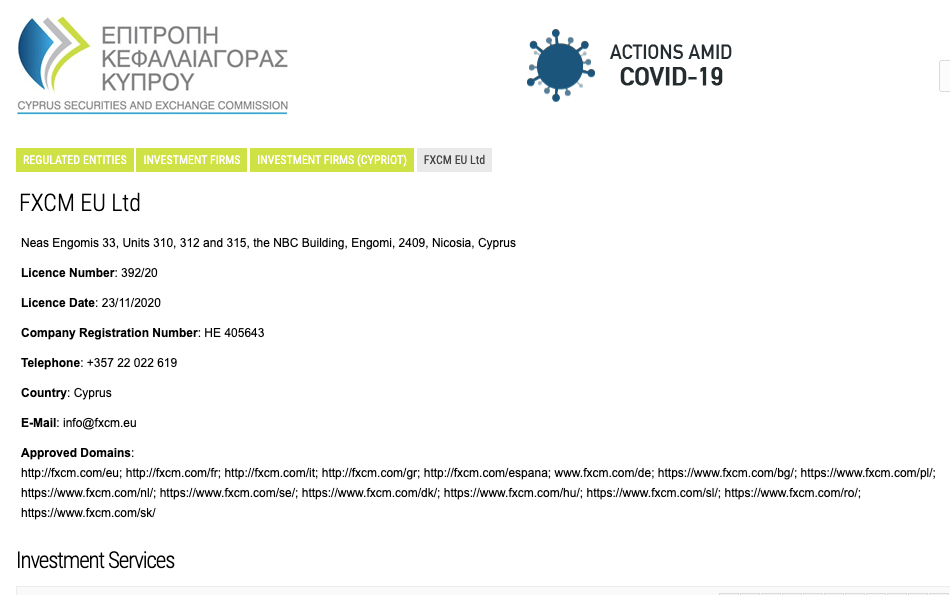

4) Cyprus Securities and Exchange Commission (CySEC): FXCM is regulated in Europe as ‘FXCM EU Ltd’ by the CySEC and licensed to offer investment services with license number 392/20, issued in 2020.

FXCM Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| South Africa | No Compensation | Financial Sector Conduct Authority (FSCA) | FXCM South Africa (Pty) Ltd |

| UK | £85,000 | Financial Conduct Authority (FCA) | Forex Capital Markets Limited |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | FXCM Australia Pty. Limited |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | FXCM EU Ltd |

FXCM Leverage

Leverage on FXCM depends on the instrument you are trading and whether you are a retail or professional trader. Retail clients have a maximum leverage of 1:30. This means that you can open a trade position worth up to 30 times the value of your deposit. For example, with a $1,000 deposit, you can open a trade position of $30,000.

The maximum leverage of 1:30 is for major forex pairs, while minor forex pairs, major indices, and gold have a maximum leverage of 1:20, it is 1:10 for other commodities and minor indices; and 1:5 for shares.

The maximum leverage on FXCM for professional clients is 1:200. The leverage can be lower for some instruments.

Note that trading with leverage involves risk and you can lose all your money. It is advisable not to trade CFDs or Forex if you do not understand it and do not use all your leverage as it increases your risk.

FXCM Account Types

FXCM offers only one account type for retail traders which is further divided into standard status or active trader status. FXCM also offers professional account status for more experienced traders.

FXCM also offers interest-free Islamic Accounts to Muslim traders as well as demo accounts for new traders. Find an overview of the account types on FXCM below:

1) Retail Account: The FXCM Retail Account is designed for retail clients and can be accessed with the MT4 trading application. You can engage in spread betting or CFDs trading with this account and trade the available markets of forex pairs, indices, commodities, and shares.

You do not pay any commission fees with this account. Spread fees start from an average of 1.3 pips for major pairs like the EURUSD and you pay swap fees whenever your trade position is kept open and it rolls over to the next trading day.

You need to deposit a minimum of $50 (ZAR 900) to start trading, with a minimum trade size of 1 micro lot and maximum leverage of 1:30. Retail Accounts on FXCM have negative balance protection, which means that you cannot lose more than the money you deposited if a trade is unsuccessful and you have a loss.

2) Professional Account: The FXCM Professional Account is designed for experienced traders who trade large volumes of financial assets and use higher leverage. You can engage in spread betting or CFDs trading with this account and trade the available markets of forex pairs, indices, commodities, shares, and cryptocurrencies.

With this account, you can access higher leverage of up to 1:200. This account has no negative balance protection, which means that you can lose more than the money in your account if your trade is unsuccessful and will be required to deposit more money to clear the negative balance.

You do not pay any commission fees for trading. Spread fees start from an average of 1.3 pips for major pairs like the EURUSD and you pay swap fees whenever your trade position is kept open and it rolls over to the next trading day.

To get a Professional Account on FXCM, you need to meet at least 2 of the 3 criteria below:

- You must have at least 1-year working experience in the financial sector

- You must have a financial instruments portfolio of more than €500,000

- You must have traded at least 10 significant volumes of financial markets every quarter over the last 12 months

Once you have the requirement, after opening a Retail Account, you then apply for an account upgrade by contacting customer support.

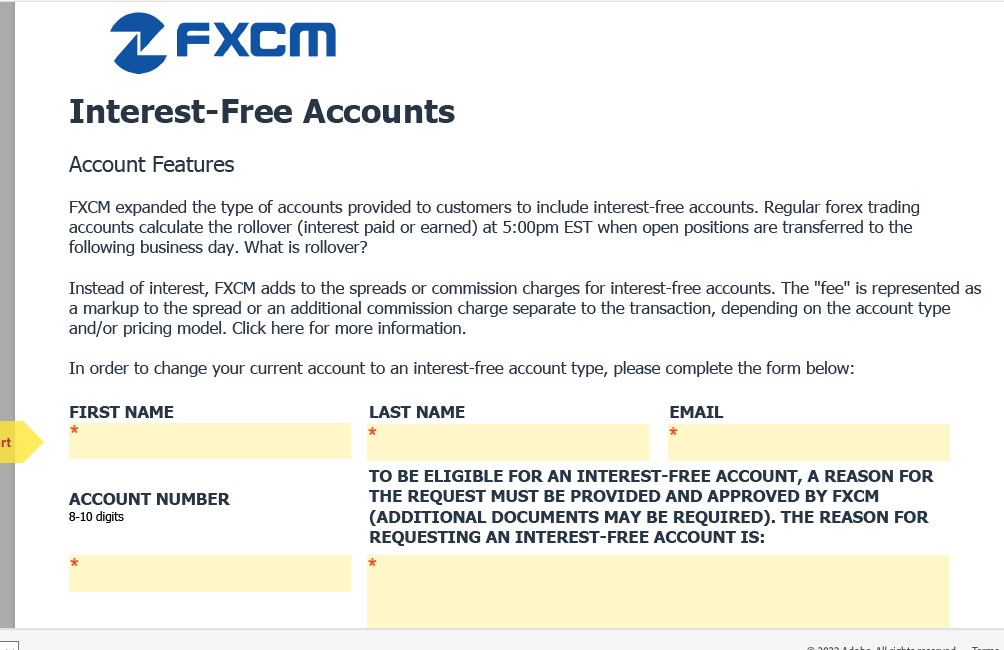

3) Islamic Account: FXCM offers Islamic Accounts to Muslim Traders which comply with the Sharia law of no-riba. Islamic Accounts on FXCM are interest-free, which means that you will not pay any overnight funding fees if you keep a trade position open past the closing time of the market.

You can have an Islamic Account as a retail trader or professional trader. To get your Retail or Professional Account converted to Islamic Account status, send a message to customer support. You will be required to fill out an application form and submit additional documentation before your application is approved.

Note that the spread fees for Islamic Accounts are higher because they pay no interest.

4) Active Trader: The FXCM Active Trader Account is an account status accorded to retail or professional traders who have a minimum notional trade volume of $10 million. The equity is calculated as your deposit plus the floating profits of your open trade positions.

As an Active Trader on FXCM, you are assigned a dedicated account manager and receive priority customer support. You will also pay lower spreads on trades and gain access to exclusive market data.

With this account status, you pay commission fees of $30 per side per million worth of trade.

FXCM Base Account Currency

You can choose from 4 currencies to serve as your account base currency on FXCM during account registration. They are British Pound sterling – GBP, Euros – EUR, Swiss Franc – CHF, and United States Dollar – USD.

All your trades, deposits/withdrawals, and profits/losses will be measured in your base account currency.

FXCM Overall Fees

Fees on FXCM depend on your account type, the instrument you are trading and the size of your trade. Find an overview of trading and non-trading fees on FXCM.

Trading fees

1) Spread: Whenever you trade an instrument on FXCM, you pay a spread fee which is the difference between the bid and ask price of the instrument. Find the average spreads charges on FXCM for major instrument pairs on the table below:

| Instrument/Pair | Standard Retail/Professional Accounts | Active Trader Accounts |

|---|---|---|

| EUR/USD | 1.3 pips | 0.3 pips |

| GBP/USD | 1.7 pips | 0.8 pips |

| EUR/GBP | 2.3 pips | 0.6 pips |

| Gold | 0.38 pips | 0.38 pip |

2) Commission fees: FXCM offers commission-free trading for all instruments on all account types, except for Active Traders. This means that whenever you open or close a trade position, you will not be required to pay any commission fees.

Active Traders pay commission fees of $50 (ZAR 900) to $60 (ZAR 1000) round turn per million worth of trade.

3) Swap fees: Whenever you keep a trade position open past the closing time of the market, which is 5 PM EST, you incur a rollover cost or swap fees. This cost is added to your profit or loss when you close the trade and is calculated based on the size of your trade, the number of days for which it was open, and whether it was a short (sell) or long (buy) position.

Islamic Accounts are swap-free (interest-free) and do not pay any swap fees whenever they keep a position open beyond the market closing time.

Non-trading fees

1) Deposit and Withdrawal fees: FXCM does not charge any fees for depositing funds into your account. When withdrawing funds from your account, withdrawals via cards and e-wallets are free of charge, while bank wire transfers attract a cost of $40 (ZAR 800) per withdrawal.

2) Account Inactivity charges: If you do not place any trade with your FXCM for one year, you will be charged an inactive account fee every year of $50, which will be deducted from any balance in your account.

If you do not have any funds in the account, your account will not be debited and you will not accumulate any negative balance.

FXCM Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | $50 per year |

| Deposit fee | Free |

| Withdrawal fee | $40 for wire transfers |

How to Open FXCM Account in South Africa?

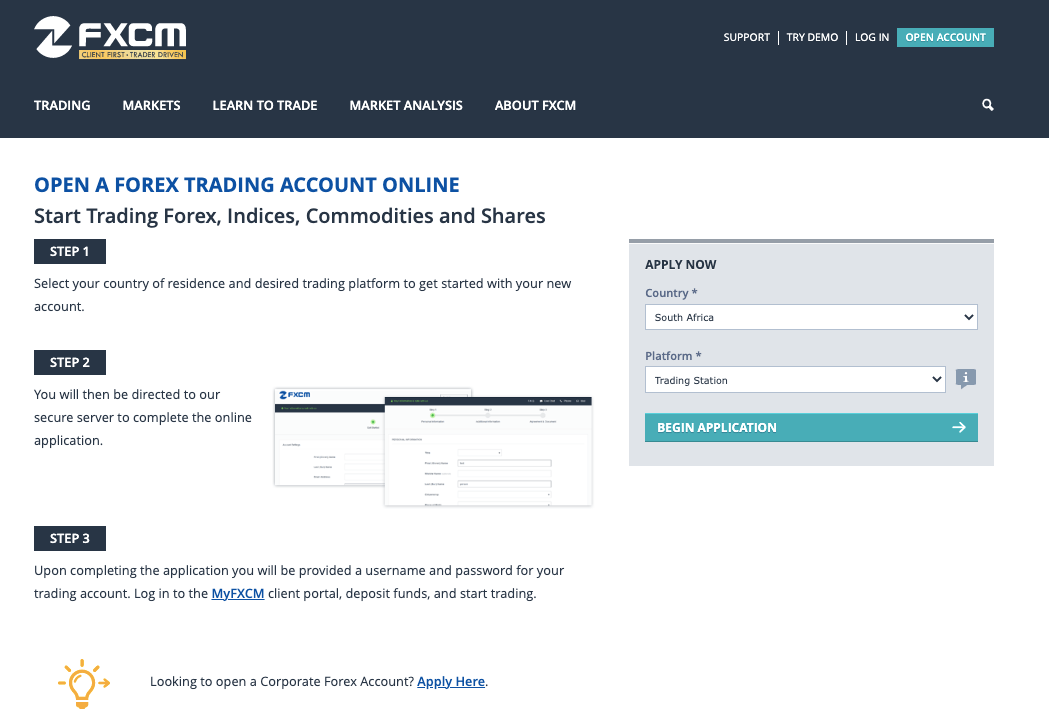

Follow these steps to open a trading account on FXCM.

Step 1) Go to the FXCM website at www.fxcm.com and click on ‘OPEN LIVE ACCOUNT’.

Step 2) Select your country of residence (South Africa will be selected automatically) and choose your preferred trading platform, then click ‘BEGIN APPLICATION’.

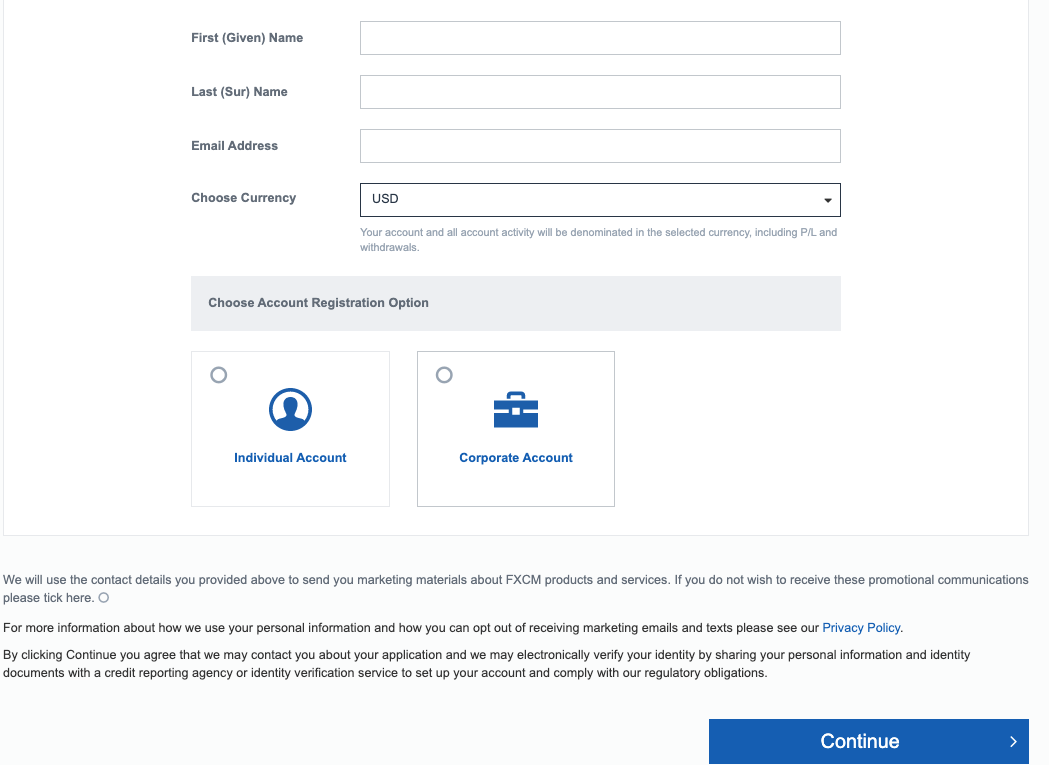

Step 3) Type in your name and email address, select your preferred account currency, choose between opening an individual or corporate account, and then click ‘Continue’.

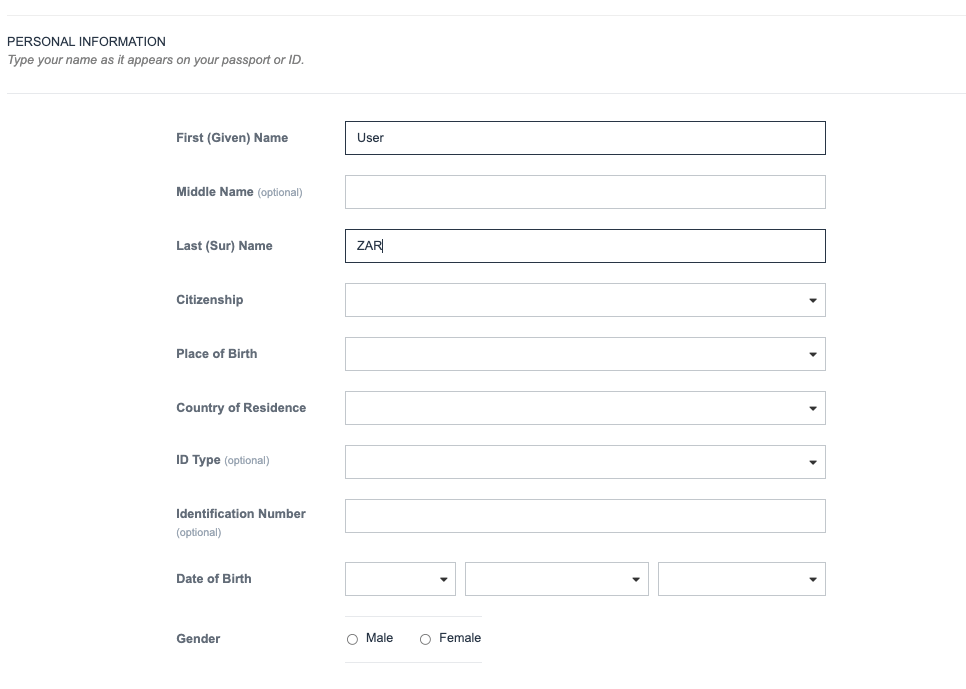

Step 4) Provide your date of birth, and ID number, phone number, address, and other personal information, then click ‘Continue’.

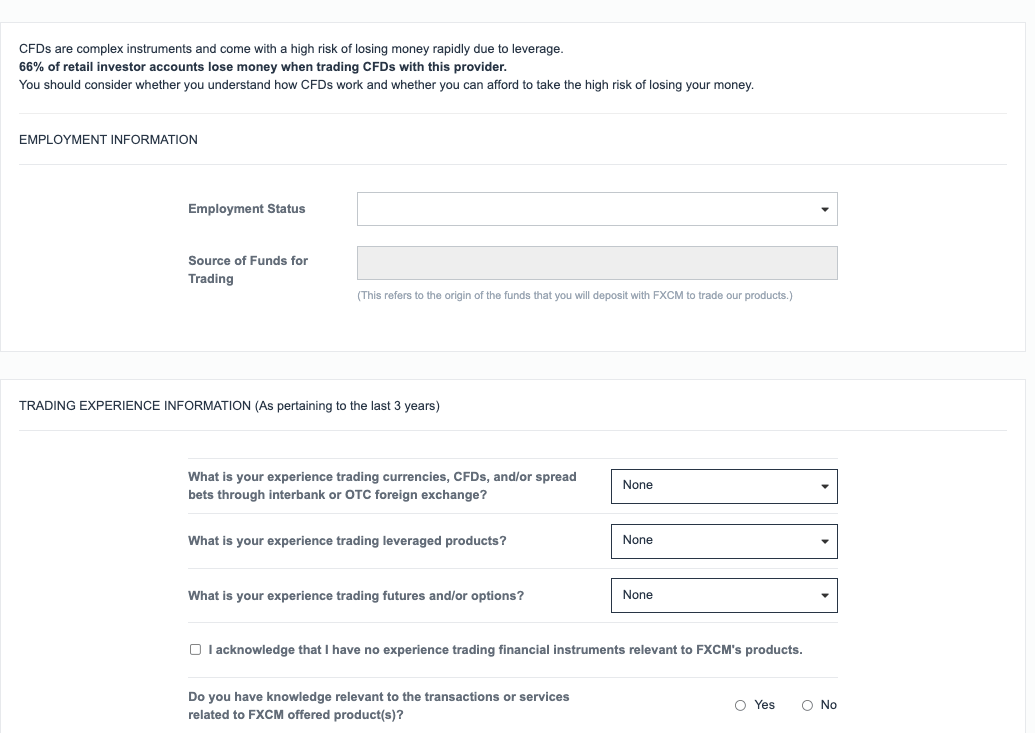

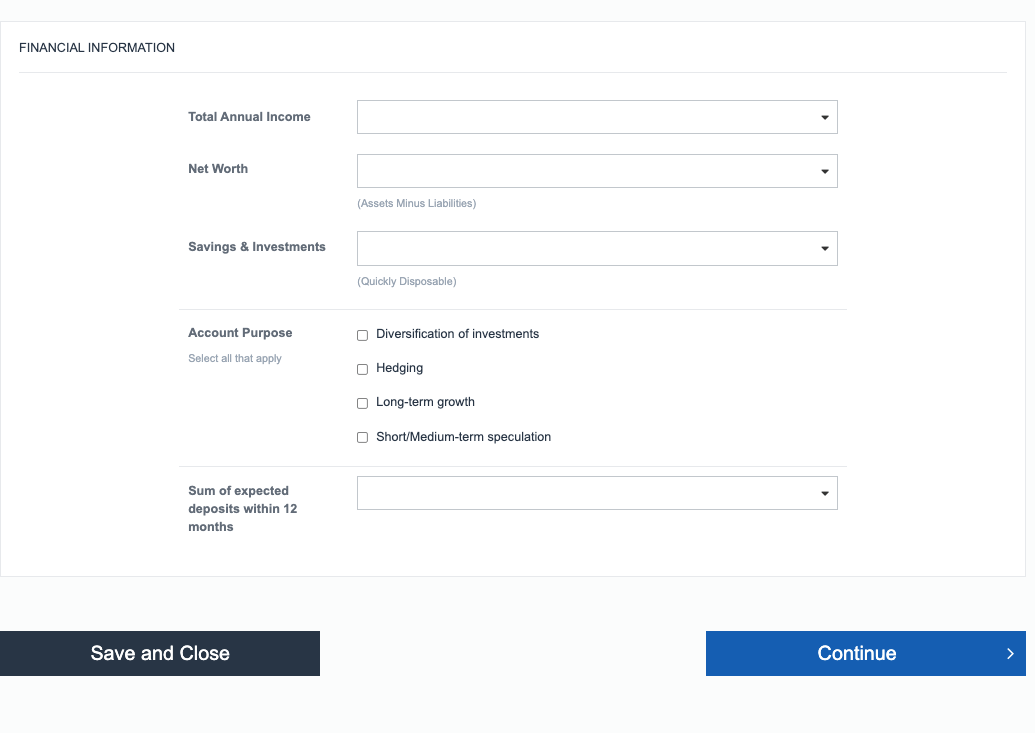

Step 5) Answer questions about your employment, financial status, trading experience, and intentions for trading then click ‘Continue’.

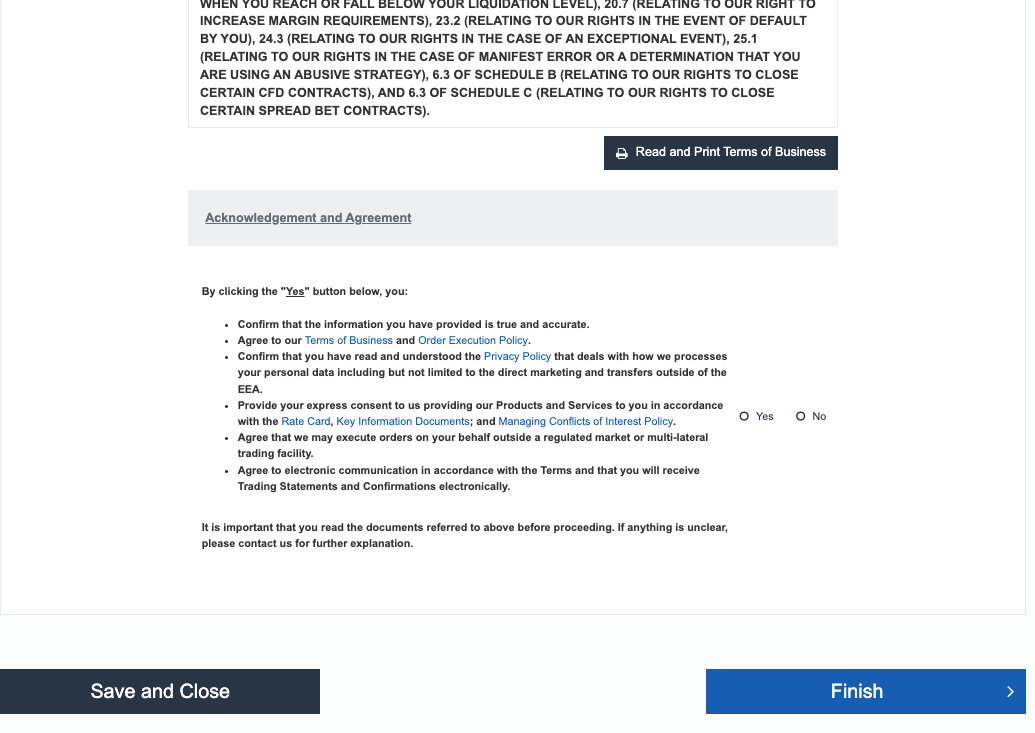

Step 6) Set a security question, set a password, check the ‘Yes’ option to agree to the Terms of Business then click ‘Finish’.

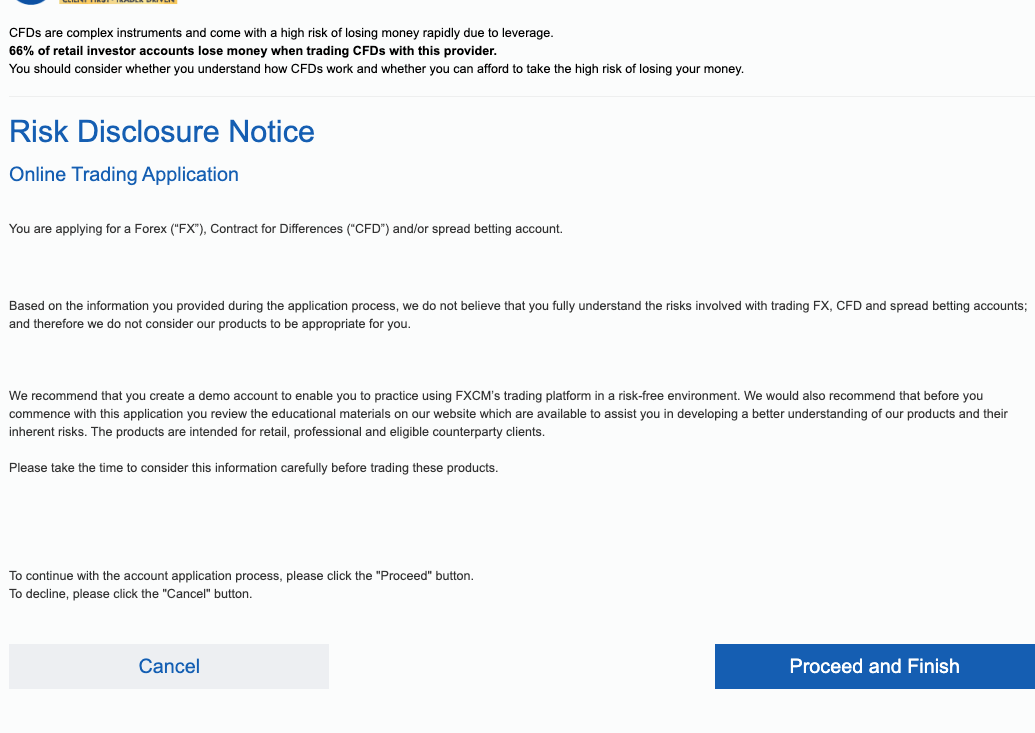

Step 7) Click on ‘Proceed and Finish’ on the page that appears to agree to the Risk Disclosure warning.

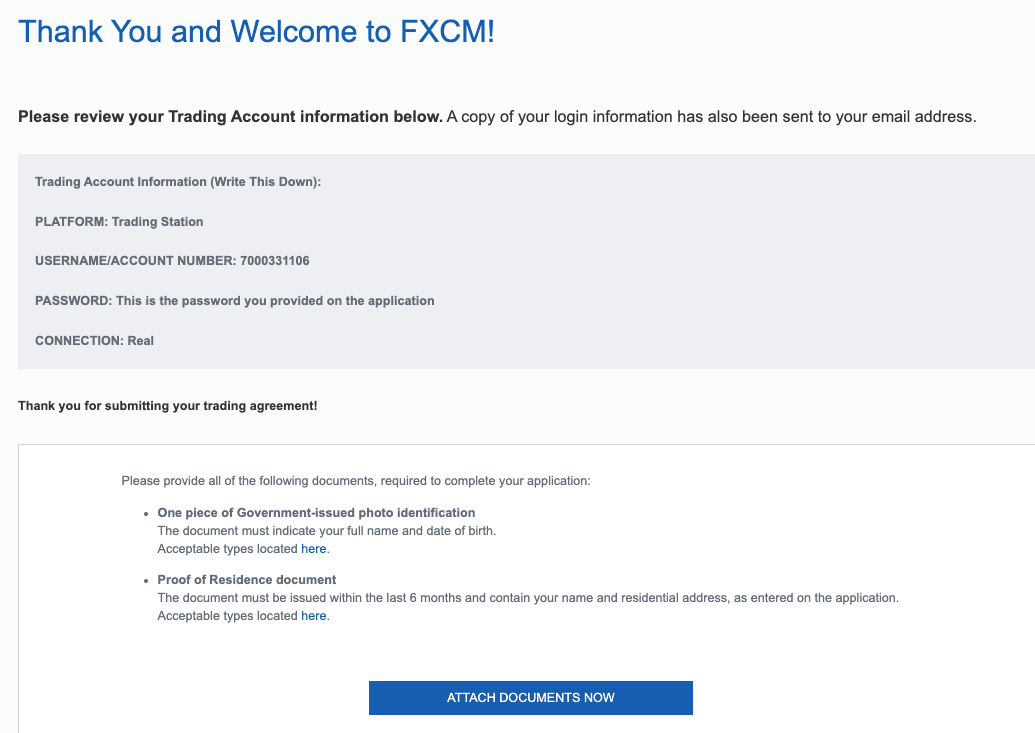

Step 8) Your account will be created and the details are shown to you. You will be required to Upload an ID Card and bill to verify your identity and address so that your account will be activated. You will also need to update your tax information when you log in.

After verifying your account, you can now deposit funds and start trading.

FXCM Deposits & Withdrawals

Payment methods accepted on FXCM for deposits and withdrawals in South Africa are bank transfers and cards (credit/debit). Find an overview of deposits and withdrawals on FXCM below:

FXCM Deposit Methods

Here is a summary of payment methods accepted by FXCM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | Free | Within 24 hours |

| E-wallet | Yes (Skrill, Neteller, etc.) | Free | 1 business day |

FXCM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FXCM.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | $40 per transaction | 3-5 business days |

| Cards | Yes | Free | 3-5 business days |

| E-wallets | Yes (Skrill, Neteller, etc.) | Free | 3-5 business days |

What is the FXCM Minimum deposit?

The minimum deposit on FXCM is $50 (ZAR 900) which applies to all payment methods.

How do I deposit money into FXCM?

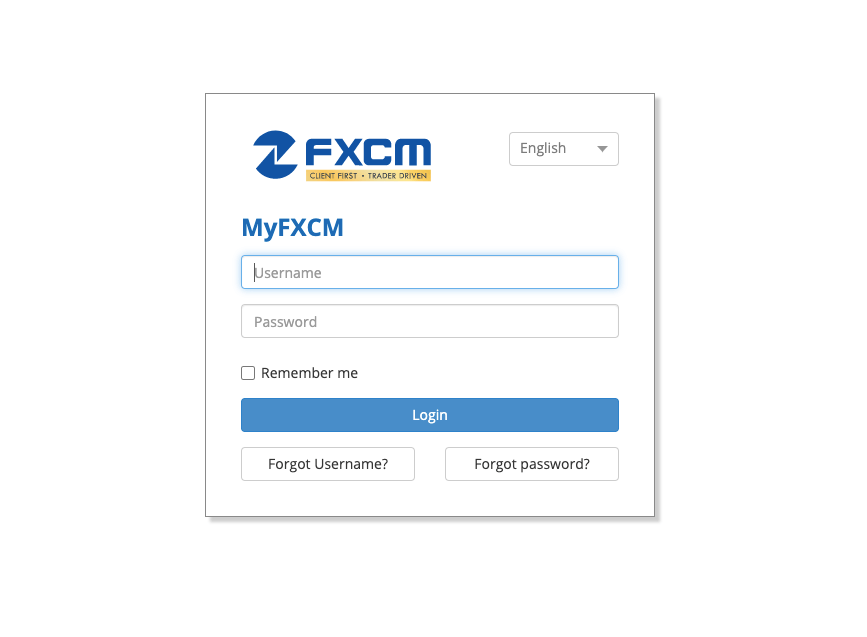

To deposit funds on FXCM, log in to your account via www.myfxcm.com, then click on Funds and select Deposit Funds. Choose a deposit method and follow the on-screen instructions to complete your deposit.

What is the FXCM Minimum withdrawal?

There is no mandatory minimum withdrawal amount on FXCM. All withdrawals are processed within 1-3 days by the accounts department. It can take up to 5 business days for you to receive the funds, depending on your financial institution.

How do I withdraw money from FXCM?

To deposit funds from FXCM, log in to your account, then click on Funds and select Withdraw. Choose a withdrawal method, enter the amount you want to withdraw and follow the on-screen instructions to complete your withdrawal.

FXCM Trading Instruments

You can trade over the following financial instruments on FXCM:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 42 currency pairs on FXCM (7 Majors, 21 Minors, and 14 Exotics) |

| Forex Baskets | Yes | 3 Forex Baskets on FXCM |

| Commodities CFDs | Yes | 12 commodities on FXCM (Oil, Agriculture and Metals) |

| Indices CFDs | Yes | 15 indices on FXCM |

| Index Baskets CFDs | Yes | 1 Index Basket on FXCM (USEquities) |

| Stocks CFDs | Yes | 204 shares on FXCM (UK, US, Hong Kong, German, France, and Australia shares) |

| Stock Baskets CFDs | Yes | 16 stock baskets on FXCM |

| Treasury (Bonds) CFDs | Yes | 1 Treasury Bond on FXCM (BUND) | Cryptocurrencies CFDs | Yes | 24 pairs of cryptocurrencies on FXCM * |

*Cryptocurrency trading are only available to Professional Clients.

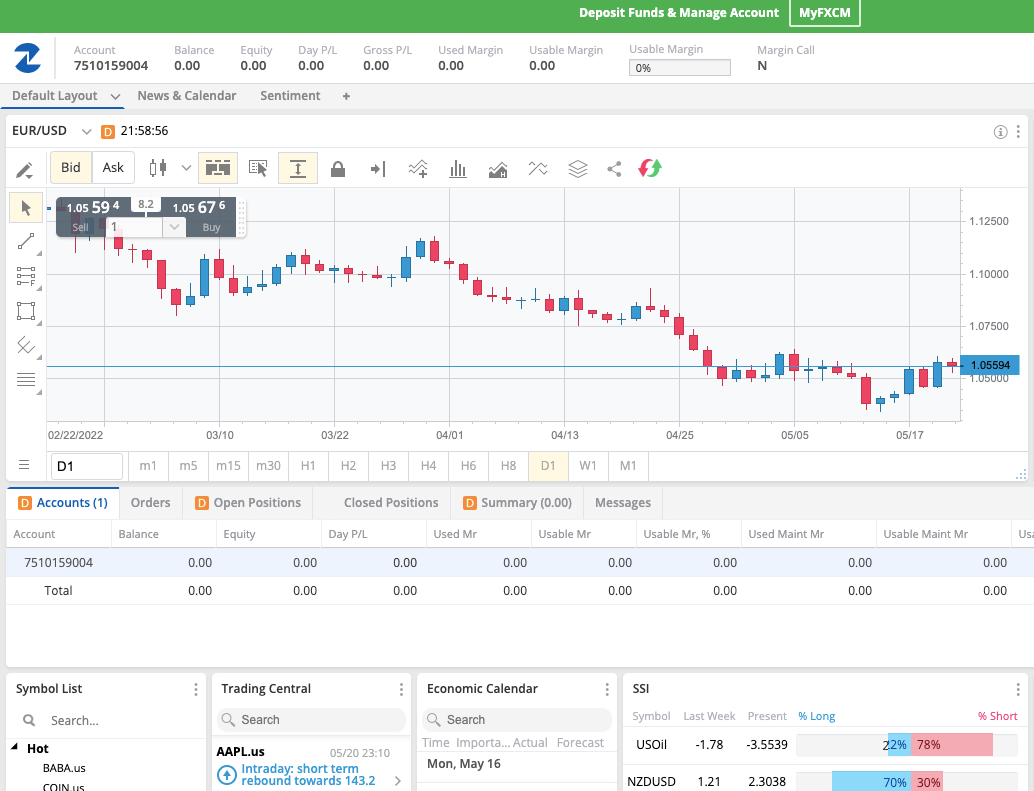

FXCM Markets Trading Platforms

Trading platforms supported by FXCM are:

1) MetaTrader 4: You can trade FXCM financial markets on the MT4 trading application, available on the web, desktop (Windows and macOS), and mobile devices (Android & iOS).

2) FXCM Trading Station: This is a proprietary trading platform developed by FXCM and can be accessed on the web, desktop, or download mobile versions on Apple App Store or Google Play Store.

3) TradingView and Capitalise AI: These are third-party Trading Applications that FXCM also supports. You can integrate them into your FXCM trader.

FXCM Trading Tools

These trading tools can be found on FXCM’s Trading Station.

1) Dynamic Charts: You can trade directly from the charts. The charts are dynamic and you can customize them to your preferred display. You can also customize the periodicity. The indicators are pre-loaded but they are just a few dozens.

Another exciting feature of the charts is that you can overlay the prices of two CFDs so you can compare them better. You can set price alerts as well.

2) Automated trading: You can take advantage of automated trading to reduce the human factor in your trading. You can use forex strategy backtesting to see how you can improve your trades. There is also the strategy optimization tool to help you adjust your code.

3) The Speculative Sentiment Index (SSI): The SSI is a proprietary indicator created by FXCM. It is a contrarian indicator that helps you monitor trending markets. It gives you a ratio that lets you know to what degree a CFD is being bought or sold.

Does FXCM have a mobile app?

Yes, FXCM has a mobile app called trading station mobile. It has over 500,000 downloads on the Google Play Store with 3.8/5 starts from 1000 reviews. It also available on the Apple App Store.

FXCM South Africa Customer Service

FXCM offers 24/5 customer support to traders via the following channels:

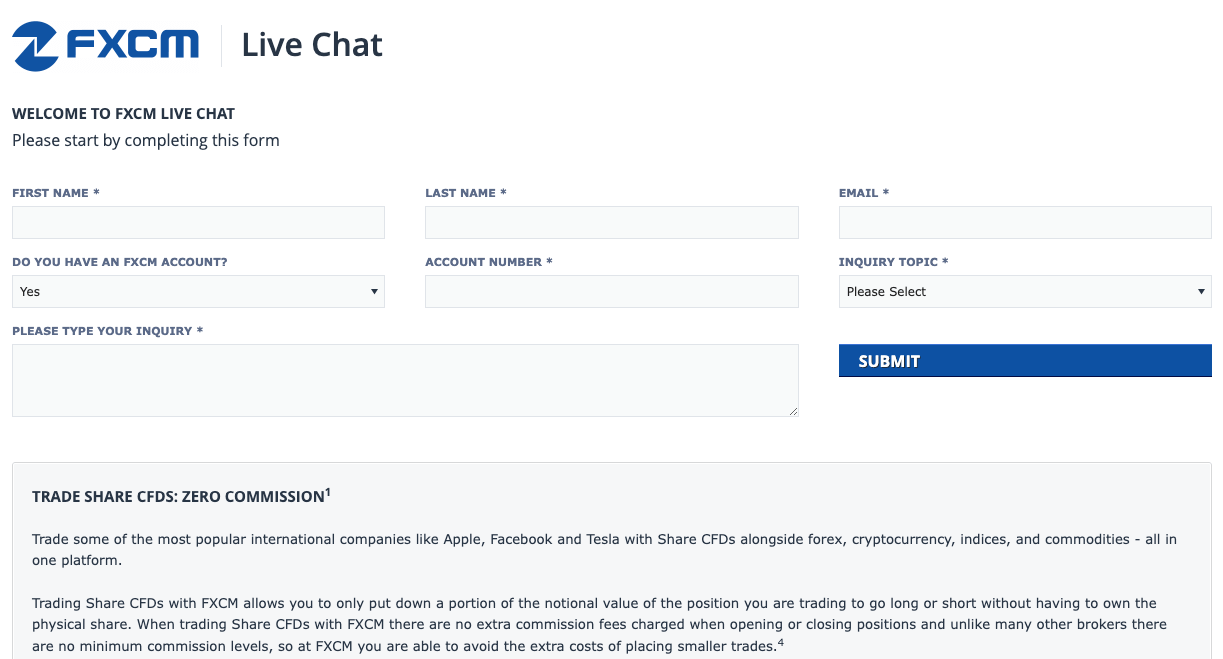

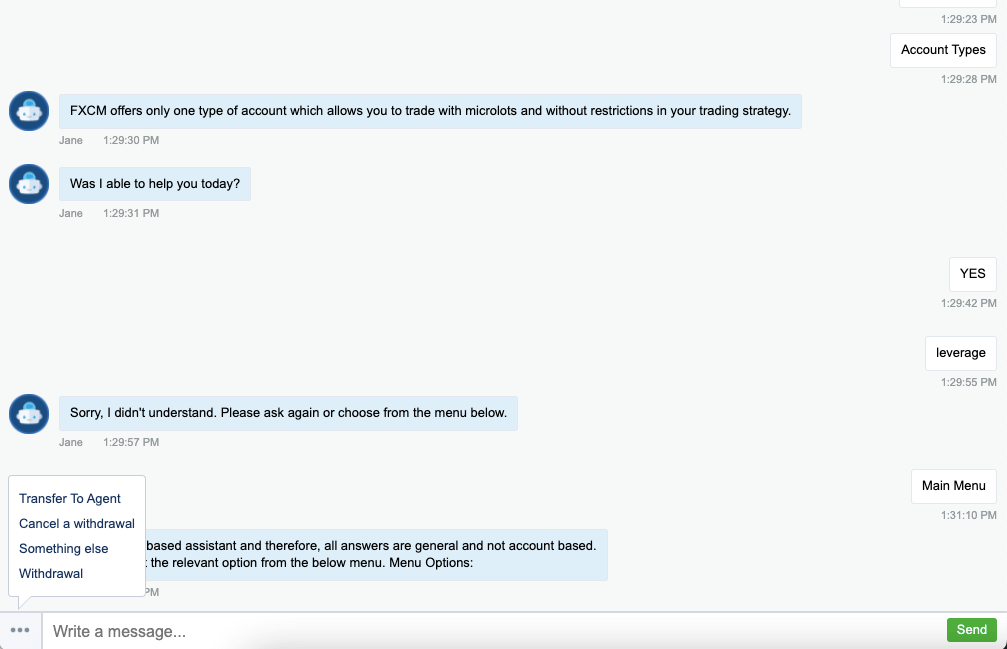

1) Live chat support: FXCM offers live chat support to traders, which can be accessed on their website. The chatbot is available 24/7, while live chat agents are available 24/5.

When our team tested, we got a response from a live agent within 2 minutes and the answers to our questions were relevant. When you first initiate a chat, you will be required to submit your name and email, then the chatbot will offer menu-based answers to questions on various topics.

You will have to click the 3 dots and select ‘Transfer To Agent’ beside the chat to talk to a live agent.

2) Email support: FXCM also offers email support for customers that is available 24/5. When our team tested, we got an autogenerated reply immediately and a live agent responded after 3 hours. The FXCM email address we sent the inquiry to was [email protected] but we got a response from [email protected].

3) Phone support: FXCM offers phone support to traders as well. You can call the FXCM phone number during business hours on working days. The FXCM phone number for support is +27 10 500 1906 or +44 7537 432259.

FXCM offers WhatsApp support to clients 24/5, you can reach FXCM on WhatsApp via +44 7537 432259.

Is FXCM a Prime Broker

FXCM provides prime brokerage services to institutional clients who require access to market data and execution across multiple trading venues with settlements managed through a centralized source.

FXCM Prime offers various services to clients such as high-frequency trading firms, hedge funds, proprietary trading firms, and small regional and emerging market banks.

Their services include centralized clearing, risk management solutions, and access to multiple trading venues. However, to use FXCM Prime’s services, customers must maintain a minimum balance of more than $250,000.

Do we Recommend FXCM South Africa?

FXCM is regulated in South Africa by the FSCA and other Top-Tier financial regulators, which makes them trustworthy because they are compliant with the regulations.

The fees on FXCM are moderate because you do not pay commission for trades, inactive account fees start after 1 year, and you can have lower spreads if you trade large volumes and become an active trader. You can also get a professional account if you want more leverage or an interest-free account for Muslim traders.

FXCM is also good for beginners because you can open a demo account and access educational materials to boost your knowledge. Retail clients also have negative balance protection and cannot lose more than the money in their accounts. FXCM also supports multiple platforms for trading although they offer relatively fewer instruments.

The customer service on FXCM is fair, live chat agents are available 24/5 and respond promptly. Although there are other brokers whose customer support is more responsive and available 24/7.

Although the broker is regulated in SA, you will have to register under FXCM Ltd UK, and you do not get a ZAR (South African Rand) account currency. They also have limited deposit and withdrawal options. There are other brokers regulated in SA who offer ZAR accounts with more options for deposits and withdrawals.

We recommend that you read up more on the FXCM website and probably chat with the customer to ask any questions you may have to help you decide if they are right for you.

FXCM South Africa FAQs

What is the minimum deposit for FXCM South Africa?

The minimum deposit at FXCM is $50 or ZAR 900 for all payment methods and account types. The accepted payment methods are bank transfer, cards and e-wallets.

Deposits via cards and e-wallets are credited to your trading account instantly, while it can take up to 2 business days for deposits via bank transfer to be credited.

Is FXCM regulated in South Africa?

FXCM is regulated in South Africa by FSCA as ‘FXCM South Africa (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 46534, issued in 2016.

How long is FXCM withdrawal?

It takes 3-5 business days. When you initiate a withdrawal, the accounts department processes it within 1-3 days. It can take up to 5 business days for you to receive the funds, depending on your financial institution. Accepted methods for withdrawals are bank transfer, e-wallets and cards.

How much does FXCM charge per trade?

FXCM charges spreads per trade that start from 1.3 pips per trade on major pairs like EUR/USD and no commissions are charged per trade for retail and professional traders.

However, if you are an Active Trader on FXCM, you pay commission fees of £25 per million value traded and spreads are lower.

What type of accounts does FXCM offer?

FXCM offers a variety of account types to suit different needs and experience levels. These include Standard Retail Accounts, Professional Account and Demo Accounts that beginners can use to get familiar with the platform practicing with virtual money before putting in their real money.

What deposit methods does FXCM offer?

FXCM offers a variety of deposit methods, including bank transfer, credit/debit card, and e-wallets like PayPal and Skrill. The deposits are instant for cards and e-wallets and up to 2 business days.

Can I use FXCM in South Africa?

Yes, you can sign up on FXCM in South Africa. FXCM is available in South Africa and is regulated by the South African Financial Sector Conduct Authority (FSCA) as FXCM South Africa (Pty) Ltd.

Who owns FXCM?

FXCM is owned by Leucadia Investments, the investment banking arm of Jefferies Financial Group, which is listed on the New York Stock Exchange.

Note: Your capital is at risk