| Tickmill Minimum Deposit Summary | |

|---|---|

| Tickmill Minimum Deposit | ZAR 100 |

| Deposit Methods | Bank transfer, SticPay, Webmoney, Skrill, Crypto Payments |

| Account Types | Pro Account, Classic Account, VIP Account |

| Deposit Fees | No fees |

| Account Base Currencies | USD, ZAR |

| Withdrawal Fees | No fees |

| Visit Tickmill | |

Tickmill’s minimum deposit is ZAR 100 . This applies to only two of their accounts. There are Tickmill trading accounts with much higher minimum deposits for CFD trading

Tickmill also has a Futures trading account with an even higher minimum deposit.

You can choose from a pool of five live accounts if you sign up with Tickmill. Our team of editors have researched all of these accounts with their minimum deposits for you. In this article, we share what we have found

How Much is Tickmill Minimum Deposit in South Africa?

Tickmill’s minimum deposit depends on the account you choose. There are some accounts with stipulated minimum deposits. There are also accounts without one.

So let us look into these Tickmill accounts.

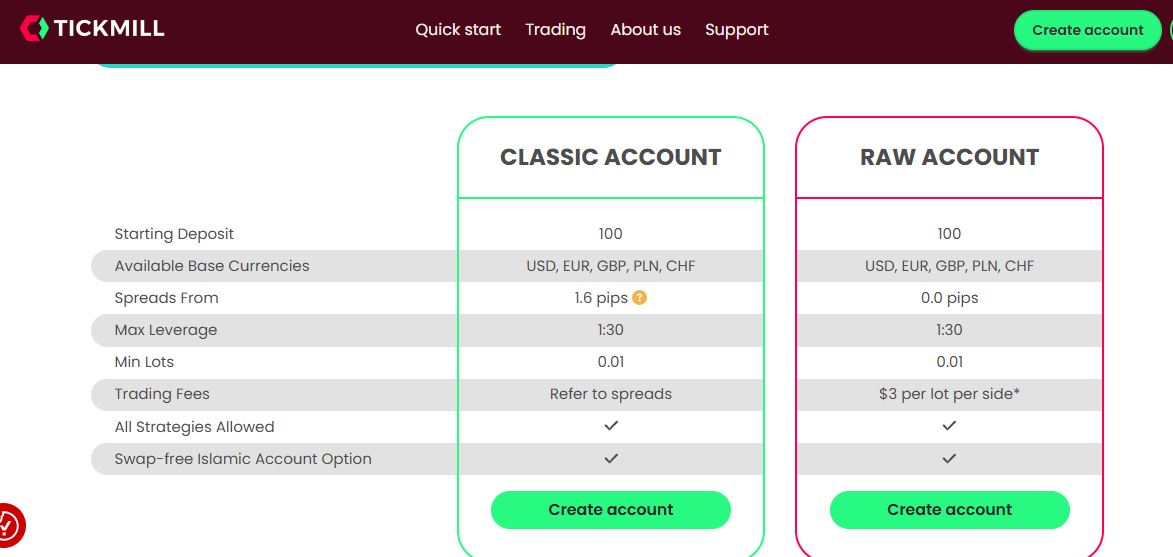

1) Classic Account

Tickmill’s minimum deposit for a Classic Account is £100 . The spread on this account is higher. They begin from 1.6 pips.

All trading strategies are allowed with 0.01 ad the minimum lot size. Trading fees refer to the spread alone. You do not have to pay any commission per standard lot on this account. That probably explains why the spreads are higher.

2) Raw Account

Tickmill’s minimum deposit for their Raw Account is £100.

This account is a low spread account with spreads beginning from 0.0 pips. You can trade all strategies on this account. Minimum lot size permitted for trading is 0.01. In terms of trading fees, you will pay a commission for every standard lot that you trade.

The fee is two $3 currency units per side per standard lot.

Tickmill Trading Accounts Overview

Note: CFD trading is risky

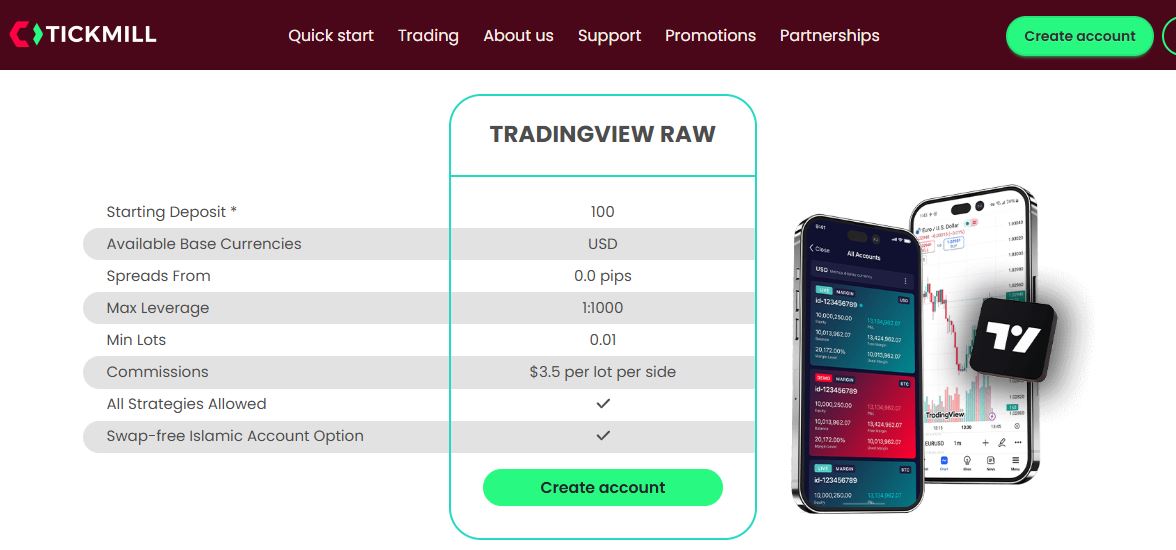

3) TradingView Raw Account

Minimum deposit for the TradingView Raw Account is $100. It is similar to the Raw Account. The difference is that the TradingView Raw Account has higher commissions.

4) Islamic Account

Tickmill’s Islamic Account is swap free and Shariah compliant. It is for Muslim traders who cannot pay or receive rollover charges because it is haram.

Tickmill’s swap-free account allows you to trade in halal way. As per our Tickmill review, you can open any of the regular accounts (Classic, Raw or TradingViewRaw) and then convert it to an Islamic Account.

This means the minimum deposits (ZAR 100) and trading conditions remain the same. The only difference is that there are no overnight charges on trading instruments.

Tickmill Deposit Methods and Required Fees

Tickmill has seven funding methods that lets you fund your account in USD. Only one method allows funding in ZAR.

Now we breakdown these channels and their fees.

1) Bank transfer: Tickmill supports funding your account through a local bank transfer in ZAR. Tickmill charges no fee but your bank will charge you per transaction. If you fund your account with more than $5000 (ZAR 93,386), Tickmill will pays your bank charges.

Payment and processing may take up to 2-7 business days.

2) Credit/debit cards: Tickmill accepts cards for Visa and MasterCard. processing of payment is also instant. No extra fees from Tickmill.

3) Skrill: Fund your account with your Skrill e-wallet without extra charges. Your money should reflect in your account instantly for free.

4) Neteller: Neteller is also provided by Tickmill for account funding.

5) SticPay: SticPay is also supported by Tickmill for South African traders.

6) Webmoney: Webmoney works in South Africa and you can use it to fund your account.

7) Crypto Payments: You can fund your accounts with digital coins

Note: Though Tickmill charges no fees for deposits, these payment service providers might charge a fee of their own. These costs will be borne by you. All the methods above allow deposit in USD.

Tickmill Deposit Terms

1) Tickmill does not accept any payments made via a third-party source. Make sure your payments comes from cards, wallets, or bank accounts that bear your name.

2) Tickmill can require proof of identity from you if they so desire. Your payment can be frozen or refunded if you do not comply.

3) You may be charged a penalty processing fee if you make a third-party payment

4) All deposits starting from 5,000 USD (ZAR 93,386) or equivalent via a single bank wire transaction under Tickmill’s Zero Fees Policy. Tickmill will also cover transaction fees up to 100 USD or equivalent.

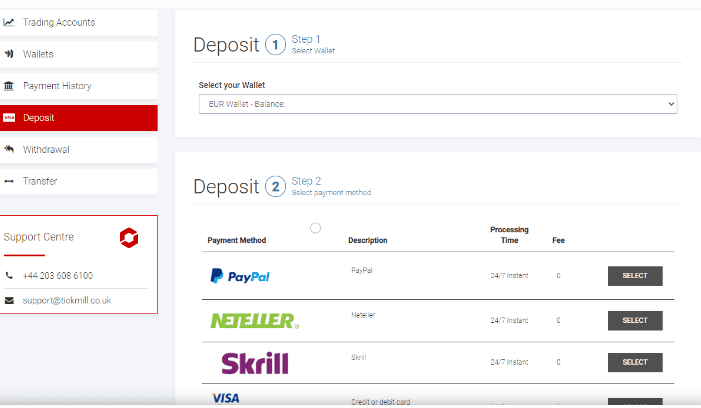

How to Deposit into Your Tickmill Account

1) Log in to your Tickmill personal area

2) Select Deposit on the left hand side. Choose your deposit method.

3) Enter the necessary details and complete your payment.

Comparison Of Tickmill Minimum Deposit With Other Brokers

| Broker | Minimum Deposit |

|---|---|

| Tickmill | ZAR 100 |

| FXCM | $50 (ZAR 910) |

| FBS | $5 (ZAR 91) |

| FxPro | $100 (R1,820) |

| AvaTrade | $100 (R1,820) |

| Plus500 | $100 (R1,820) |

Note: CFD trading is risky

What base currencies are accepted by Tickmill?

Tickmill allows the following currencies for deposits: GBP, USD, EUR, and ZAR. Ensure you only deposit in your account’s base currency to avoid currency conversion fees.

What is Tickmill minimum withdrawal?

For all withdrawal methods, the minimum withdrawal for Tickmill is ZAR 25.

Note: Exchange rates from dollars to rand is accurate as at March 26,2025.

Frequently Asked Questions

What is the minimum deposit for Tickmill in South Africa?

The minimum deposit for Tickmill in South Africa is ZAR 100.

What is the minimum leverage in Tickmill?

The minimum leverage for Tickmill is 5:1 for retail clients. This leverage does not apply for all CFDs offered by Tickmill.

How do I deposit money into Tickmill?

You can deposit money to your Tickmill trading account by logging in to your client area. From there, you can choose your deposit method.

Does Tickmill accept PayPal?

Traders in South Africa cannot fund their account through PayPal. Tickmill does not support PayPal in South Africa.

How long does it take to withdraw from Tickmill?

It depends on channel you choose to withdraw your funds. The shortest time is within a working days. However, withdrawing though a bank can take up to 2-7 business days.

Is Tickmill regulated in South Africa?

Tickmill is a well-regulated broker. They are licensed with South Africa’s Financial Sector Conduct Authority and other top-tier regulators.

Note: Your capital is at risk