Octa is a Forex broker that is registered in the Island of Moheli, Comoros Union as Octa Markets Ltd. and they offer Forex trading and CFDs on indices, cryptos, metals, and energies through OctaTrader, MT4 and MT5 platforms.

Octa’s entity is regulated in South Africa but they are not a licensed ODP. The counter party to your trades is their foreign entity. The have 24 hours live chat and email support from Mondays to Sundays. They are a popular copytrading broker.

It is important to note that Octa does not support ZAR base currency accounts, and they only have USD & EUR as the account currency choices. They also don’t have a local phone number in South Africa. Octa was formerly called OctaFX.

We have reviewed some important points in this review for SA based traders.

| Octa Review Summary | |

|---|---|

| 🏢 Broker Name | Octa |

| 📅 Establishment Date | 2011 |

| 🌐 Website | www.octafx.com |

| 🏢 Address | 9 Bonovo Road – Fomboni, Island of Moheli, Comoros Union |

| 🏦 Minimum Deposit | R480 (Local Bank Transfer) |

| ⚙️ Maximum Leverage | 1:1000 |

| 📋 Regulation | FSCA, MISA, CySEC, FSC |

| 💻 Trading Platforms | MT4, MT5, Octa Trader on Web, Desktop, Android & iOS |

| Start Trading with Octa | |

Octa Pros

- Regulated in South Africa under the entity name Orinoco Capital (Pty) Ltd

- Has negative balance protection

- Supports copy trading

- Customer service is available 24/7

- Does not charge dormant account fees

- Offers commission-free and swap-free trading

- Has auto trading robots, Expert Advisor (EA) and cBot

Octa Cons

- Octa is not a licensed ODP in South Africa

- Have fewer Forex and CFDs Trading Instruments

- No local phone numbers for support in SA

- Only 1 base account currency (USD)

- Does not have ZAR account currency

Is Octa Legit?

Octa is a legit broker, although they are considered a moderate risk because they are licensed by only two Tier-2 regulations, CySEC and the FSCA. Here are the details of the broker’s regulations:

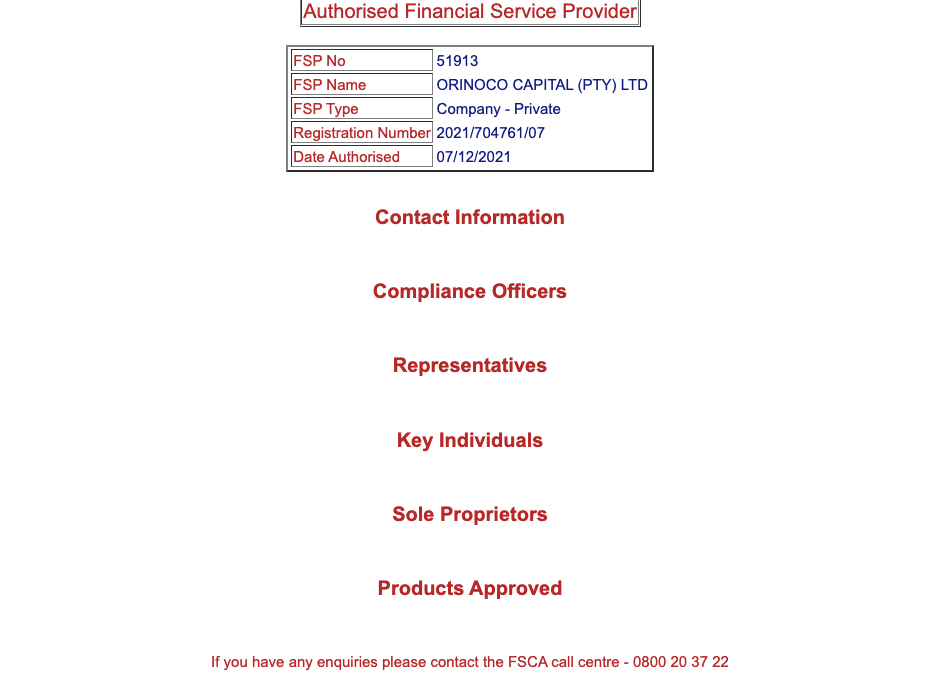

1) Financial Sector Conduct Authority (FSCA), South Africa: Octa is licensed in South Africa as a financial service provider under the name Orinoco Capital (Pty) Ltd, with FSP number 51913, issued in 2021.

Note: Orinoco Capital (Pty) Ltd is not an approved ODP. The entity acting as a counter-party to your trades is Octa Markets Ltd which is regulated with MISA in Comoros Islands

2) Mwali International Services Authority (MISA), Comoros: Octa is regulated in Comoros by MISA as Octa Markets Ltd. The company number is HY00623410 while the license number is T2023320. This is an offshore regulation. Traders based in South Africa are registered under this regulation.

Note that the customer protection policies of the offshore regulation may not cover traders based in South Africa, which means trading with this broker is at your own risk.

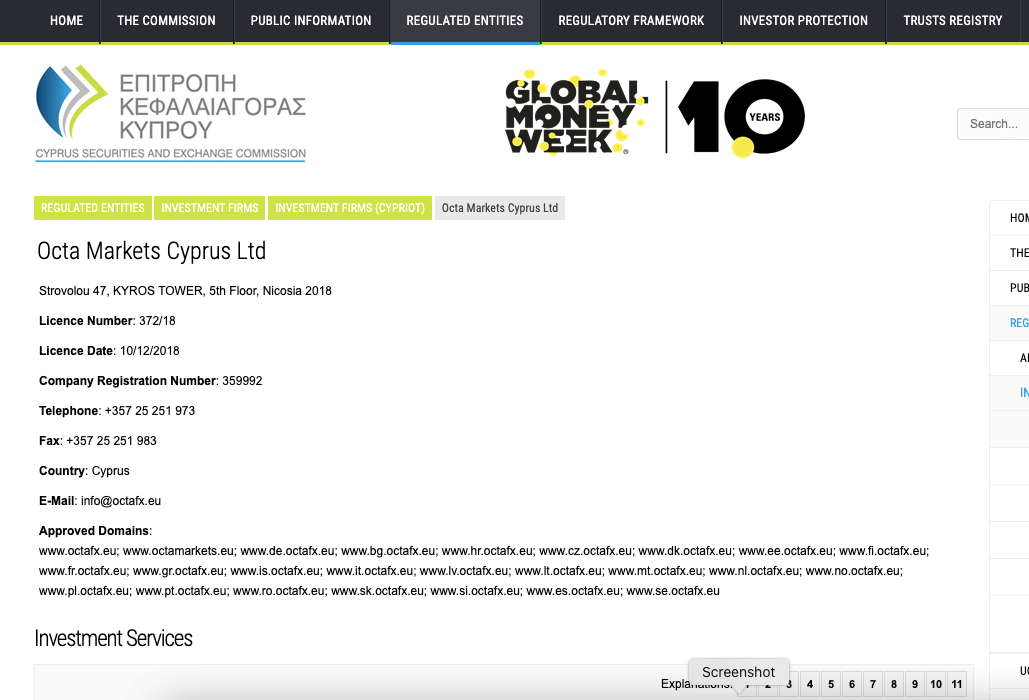

3) Cyprus Securities & Exchange Commission (CySEC): Octa is licensed by the CySEC, registered as Octa Markets Cyprus Ltd, which is on their European website www.octafx.eu.

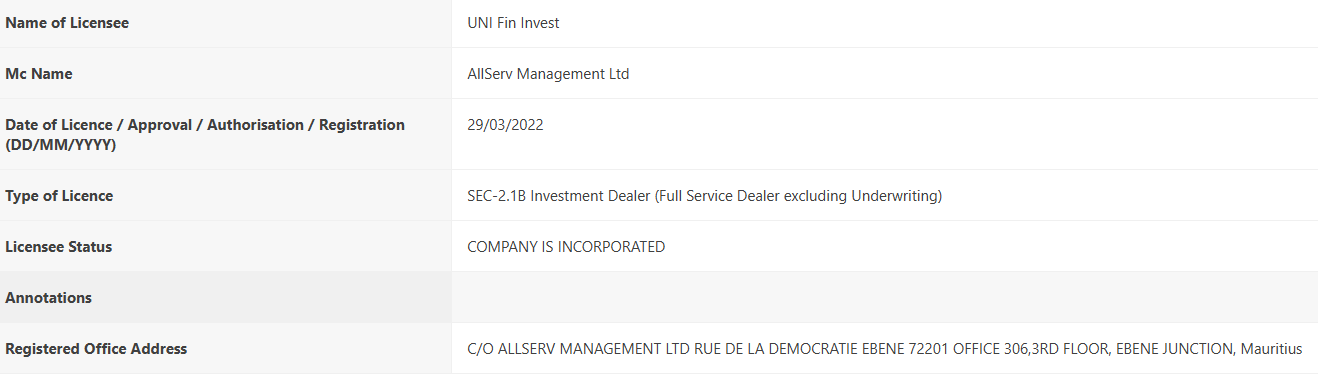

4) Financial Services Commission, Mauritius (FSC): Octa’s entity Uni Fin Invest (company registration no. C186509) is licensed with license no. GB21027161. This is an offshore regulation.

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| EU (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Octa Markets Cyprus Ltd |

| South Africa | No Compensation | Financial Sector Conduct Authority (FSCA) | Orinoco Capital (Pty) Ltd. |

| Other Countries | No Protection | Mwali International Services Authority (MISA) | Octa Markets Ltd |

Octa Leverage

Leverage on Octa depends on the type of account or instrument you are trading.

The maximum leverage on Octa is 1:1000 with applies to most forex pairs, other leverage limits are 1:400 for metals, 1:400 for oil, 1:400 for indices, 1:200 for cryptocurrencies, and 1:40 for stocks.

With leverage of 1:1000, you can open a trade position worth 1000 times the value of your savings. For example, if you deposit $100, you can place a trade of $100,000.

Note: Trading leveraged products involves risks and you can lose your money in the process. It is best to avoid trading CFDs unless you understand it and have experience. It is important that you do not use all the leverage available on your account as this increases the risk of capital loss.

Octa Account Types

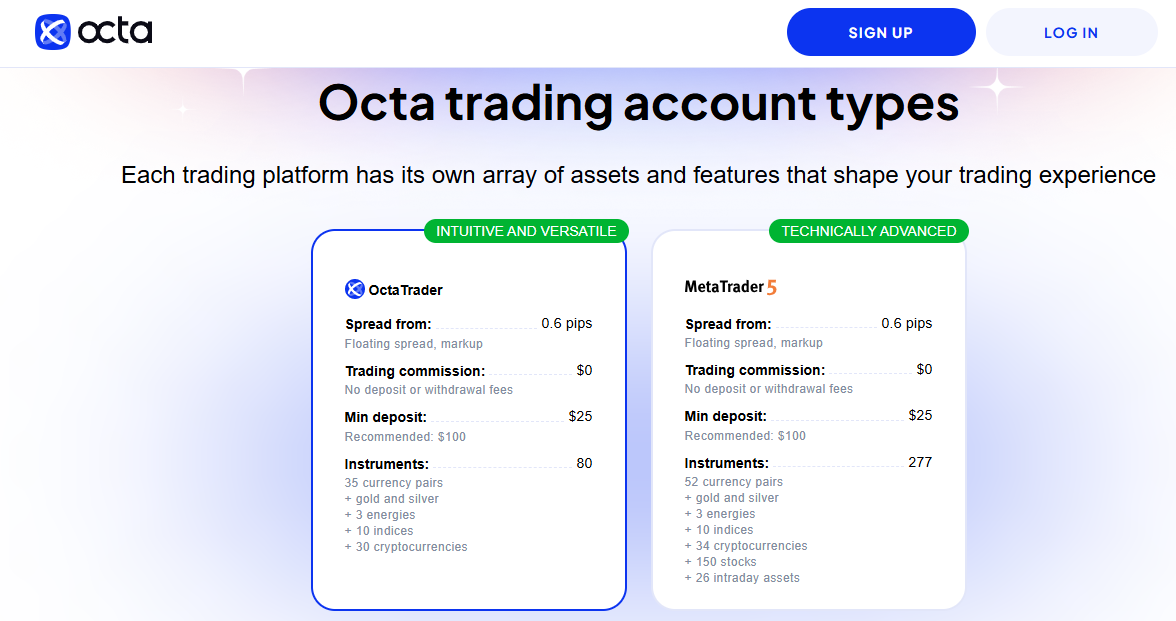

Octa has two basic account types based on the trading platforms, OctaTrader and MT5, which are swap-free. Here are the detailed features of the account types:

1) OctaTrader Account: This account type can be accessed on the OctaTrader trading application. The minimum volume of trade is 0.01 lots and the maximum volume is 50 lots, with a maximum leverage of 1:1000 leverage.

Spreads on this account start from 0.6 pips, you do not pay any commissions on trades, and no swap fees are charged for keeping an open position overnight.

Tradeable instruments on this account type are currency pairs, and CFDs on energies, metals, cryptocurrencies, and 10 indices. Recommended deposit amount is USD100.

The account has negative balance protection which means you cannot lose more than your deposits. If you suffer a loss from an unsuccessful trade, any negative balance that accrue in your account will be reset to zero and you will not need to deposit any money to clear the negative balance.

2) Octa MT5 Account: This account type is suited for experienced traders and can be accessed on the MetaTrader 5 trading application. The minimum volume of trade is 0.01 lots and the maximum volume is 500 lots, with a maximum leverage of 1:1000 leverage.

Spreads on this account start from 0.6 pips, you do not pay any commissions on trades, and no swap fees are charged for keeping an open position overnight.

Tradeable instruments on this account type are currency pairs, and CFDs on energies, metals, cryptocurrencies, stocks, 21 intraday assets on Octa and 10 indices. Recommended deposit amount is USD100.

The account has negative balance protection which means you cannot lose more than your deposits. If you suffer a loss from an unsuccessful trade, any negative balance that accrue in your account will be reset to zero and you will not need to deposit any money to clear the negative balance.

3) Octa MT4 Account: Octa’s MT4 account conditions are similar to their MT5 account. But you cannot trade stock CFDs under Octa.

4) Swap-free Islamic account: All accounts on Octa are swap-free. This makes it easy for Muslim traders as they do not need to apply for a special Islamic Account in compliance with Sharia law of no interest.

All Octa accounts are swap-free.

Demo accounts are available for new traders on Octa to help them understand the trading platform before they open a live account and put their money.

Octa features negative balance protection for all trader’s account types, which means customers cannot lose more than the money they have in their trading account in case a position is not successful. If there is any negative balance from an unsuccessful position, the account is reset to zero balance.

Octa Base Account Currency

Currently, the base currency available on Octa is the United States Dollar – USD in South Africa.

Although Octa does not offer ZAR account currency you can deposit South African Rand via local banks and it will be converted into your chosen account currency. All trading, fees, deposits/withdrawals, and profits/losses will be shown in your chosen currency.

Octa Overall Fees

We compiled a summary of the trading fees and non-trading fees on Octa.

Trading fees

1) Spreads: Whenever you trade an instrument on the Octa platform, the broker adds a markup to the ask price of the instrument. The markup which is the difference between the ask price and the bid price is referred to as the spread, measured in pips.

Octa operates floating spreads system. The typical spread starts at 0.6 pips for major currency pairs like EURUSD with OctaTrader & MT5 Accounts. Average spreads for major pairs on Octa are shown on the table below:

2) No Commissions per lot: Octa charges no commission fees per trading lot opened on both the OctaTrader, MT4 and MT5 accounts types. Octa is a spread only market maker forex broker.

Octa Trading fees Table

Here is a summary of the typical fees Octa charges on select instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 0.9 pips | None |

| GBP/USD | 1 pip | None |

| EUR/GBP | 2.1 pips | None |

| XAU/USD (Gold) | 2 pips | None |

| XTI/USD (crude oil) | 0.7 pips | None |

| US30 | 9.6 pips | None |

| SPX500 | 1.5 pips | None |

3) Swap Fees: Octa does not charge any swap fees for keeping a trade position open past the market’s closing time. Octa announced in June 2022 that the platform is now swap-free, which means no overnight funding cost or rollover fees. This applies to all account types and tradable instruments.

Non-trading fees

1) Deposit and Withdrawal Fees: Octa charges zero deposit fees and zero withdrawal fees on all accepted payment methods and account types.

2) Account Inactivity charges: Octa does not charge any inactive account fees. Whether or not you log into your account for any amount of town, your funds will be untouched.

Octa Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that although the broker charges zero deposit/withdrawal fees, your independent financial institution may charge some fees.

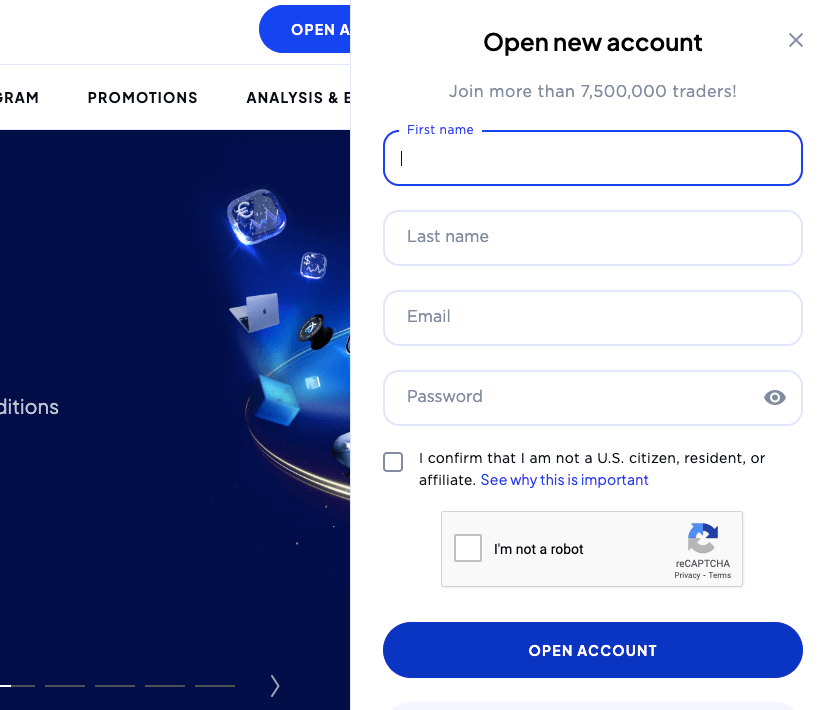

How to Open Account at Octa South Africa?

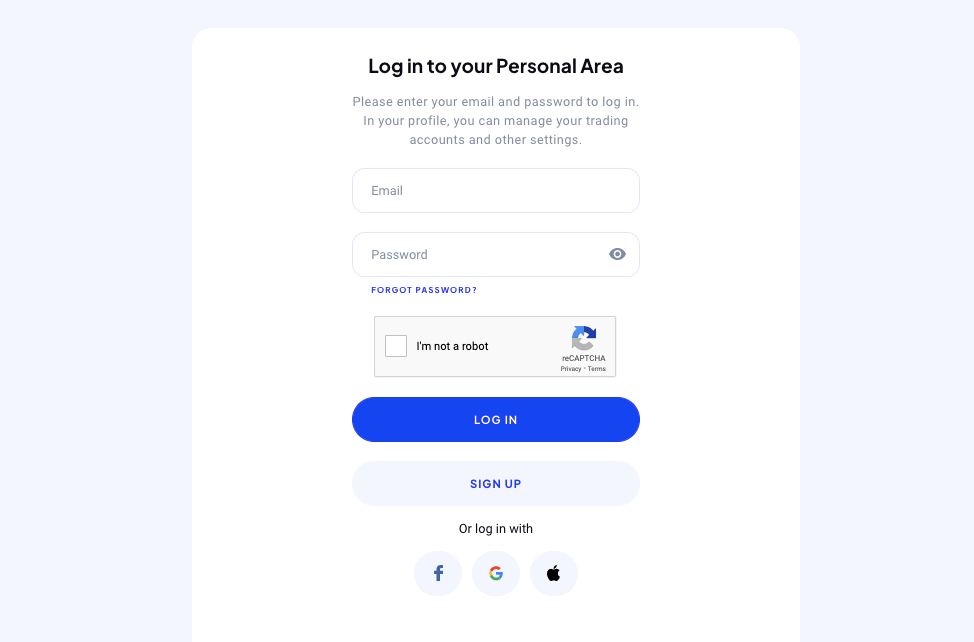

Step 1) To open a trading account on Octa in South Africa, go to their website homepage at www.octafx.com and click on the ‘Open Account’ button, highlighted in blue colour, at the top right side of the home page.

Step 2) Fill in your name, email address, create a password, check the box to accept the terms and conditions after reading, check the re-CAPTCHA box to confirm you are not a robot, then click on ‘Open Account’.

Step 3) A confirmation link will be sent to your email address to complete your registration. Go to your email inbox and click on the ‘Confirm’ blue button to confirm your email and continue the registration process.

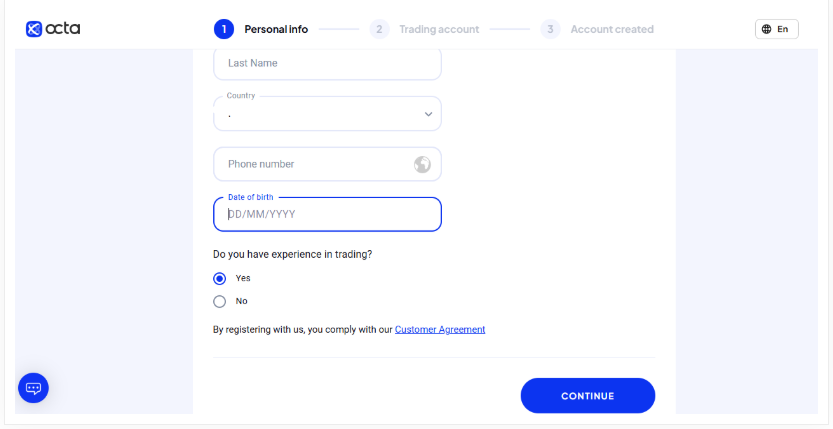

Step 4) After clicking the confirm button from the email, you will be taken to a page to provide some personal information, like phone number, address and city, and date of birth. Answer ‘Yes or No’ if you have traded Forex before, then click ‘Continue’.

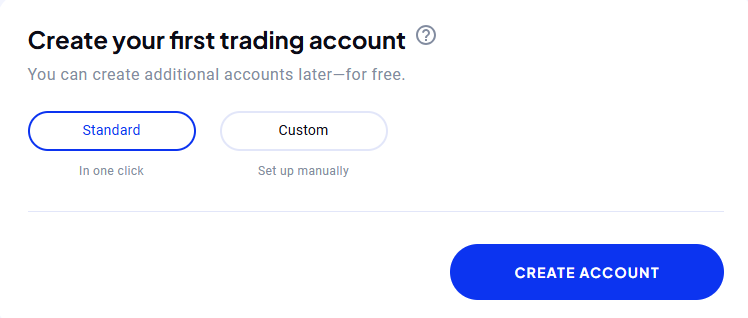

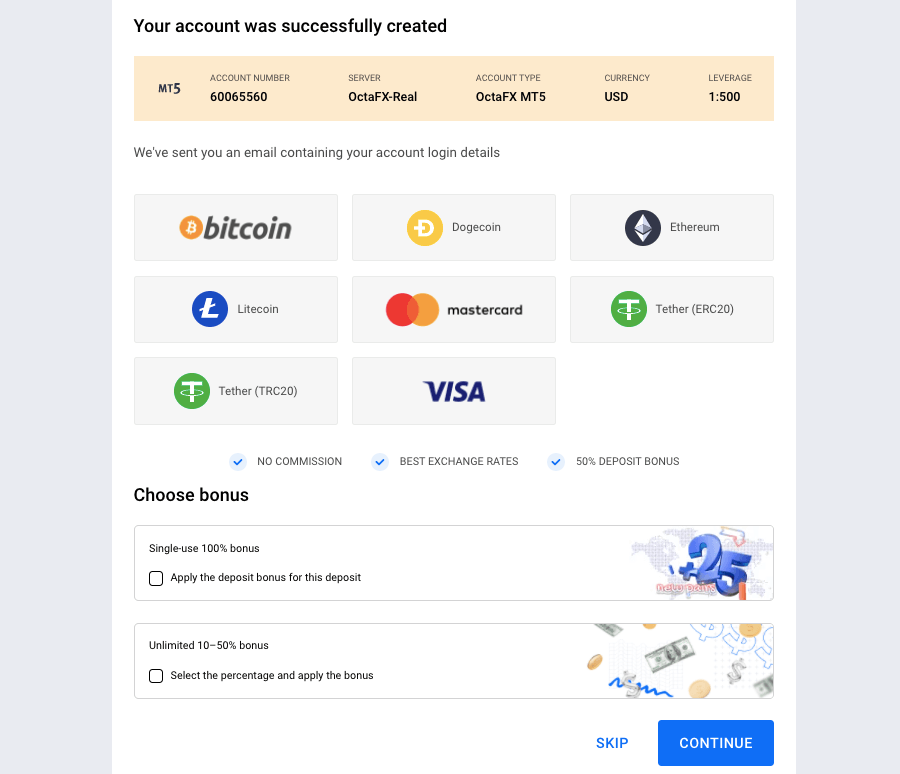

Step 5) Step 5) Create your trading account. We recommend you choose the one click set up. After this, click “CREATE ACCOUNT”. You can edit other details like leverage after the account has been created

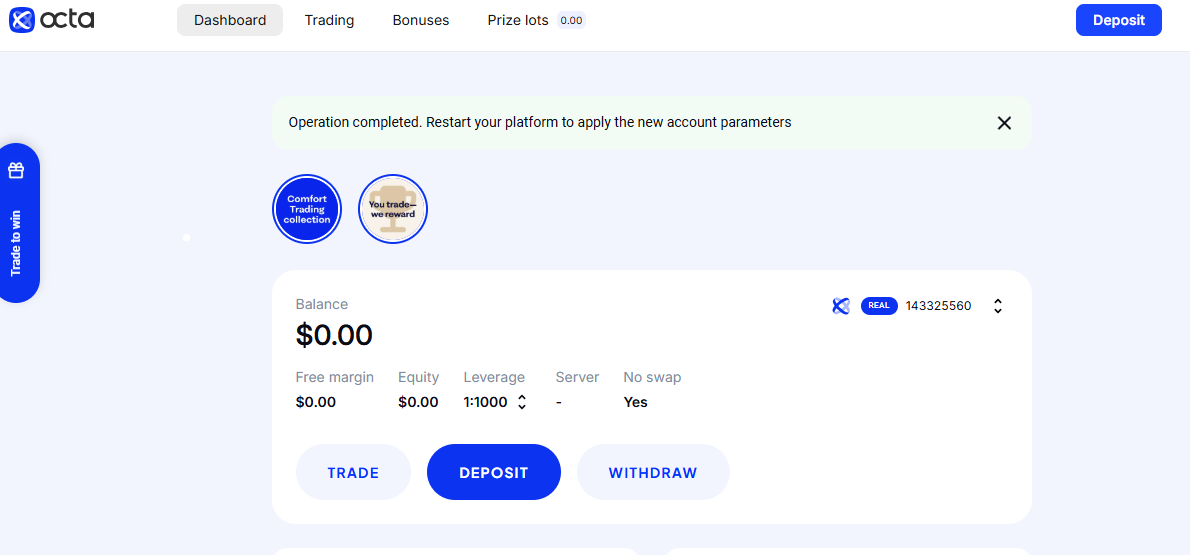

Step 6) Step 6)Immediately, you will be taken to your account dashboard. This is where you can change your trading parameters like leverage.

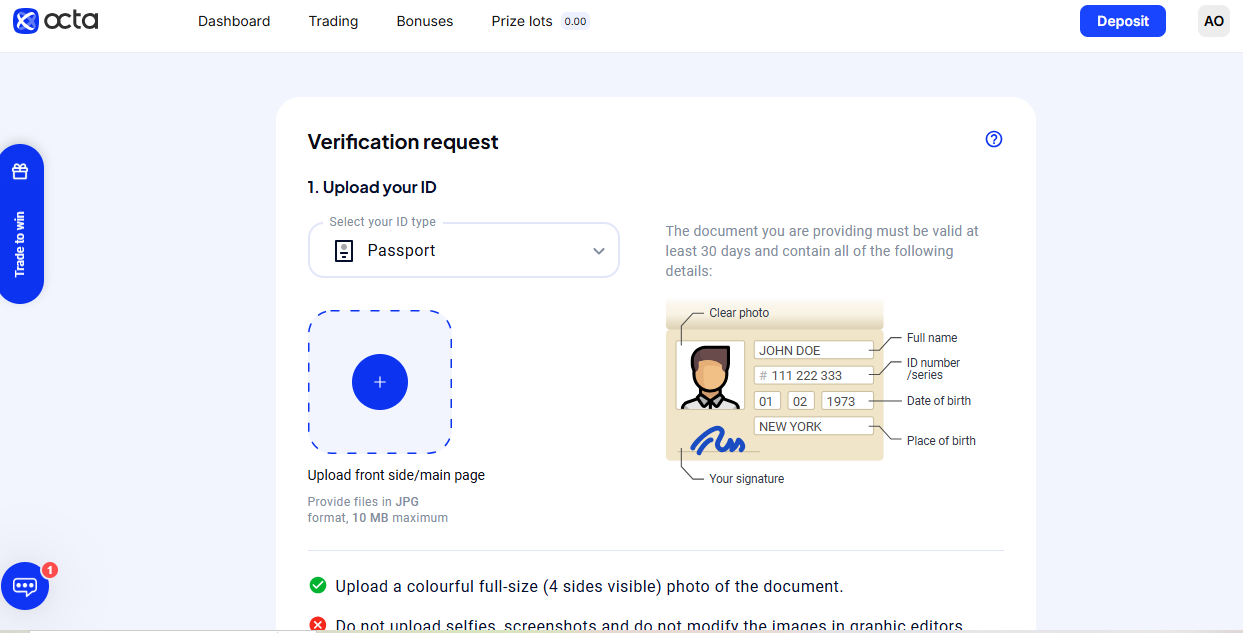

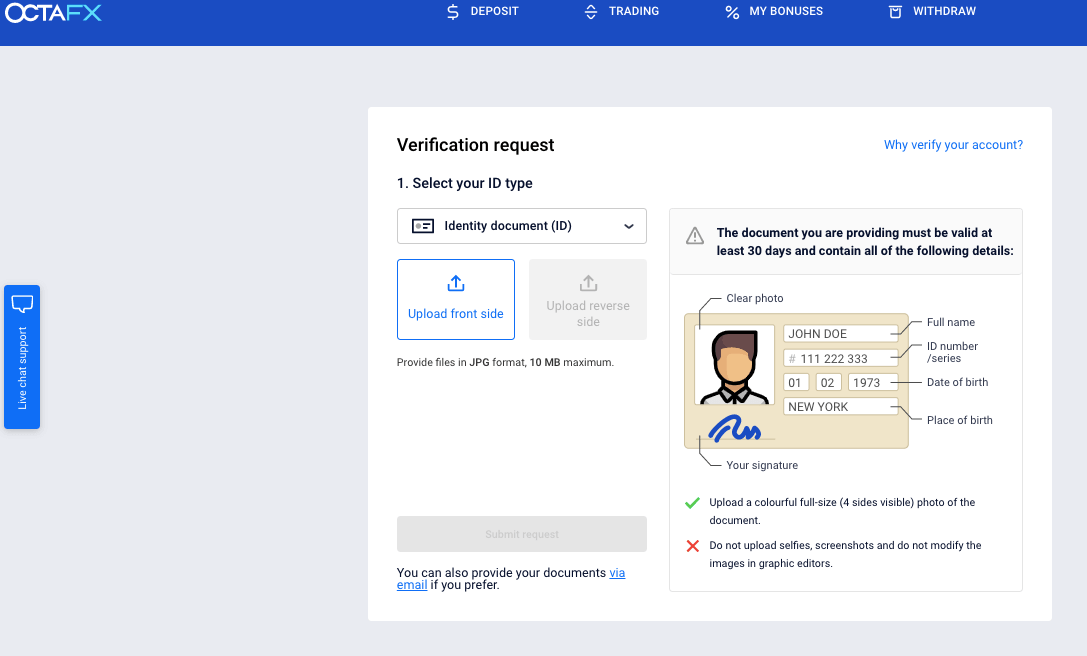

Step 7) Submit your verification request. You will be required to provide a valid ID and any document with your date of birth.

Once your verification is complete, you will be able to fund your account with any deposit method and start trading.

Octa Deposits & Withdrawals

Octa accepts deposits from all South African banks and allows withdrawals to all South African banks. You can also deposit via cards, e-wallets and cryptocurrencies. Withdrawals can only be made to the same account from which the deposit was made, and must be in the account holder’s name. No third-party deposits/withdrawals are accepted on Octa.

Find a summary of the deposits/withdrawal options on Octa.

Octa Deposit Methods

Here is a summary of payment methods accepted by Octa for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (ZAR) | Free | 1-3 hours |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | Instant |

| Crypto | Yes (DOGE, LTC, ETH, BTC, Tether) | Free | 3-30 minutes |

Octa Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Octa.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (ZAR) | Free | 1-4 hours |

| Cards | Yes | Free | 1-4 hours |

| E-wallets | Yes (Skrill & Neteller) | Free | 1-4 hours |

| Crypto | Yes (DOGE, LTC, ETH, BTC, Tether) | Free | 1-4 hours |

How much is Octa minimum deposit?

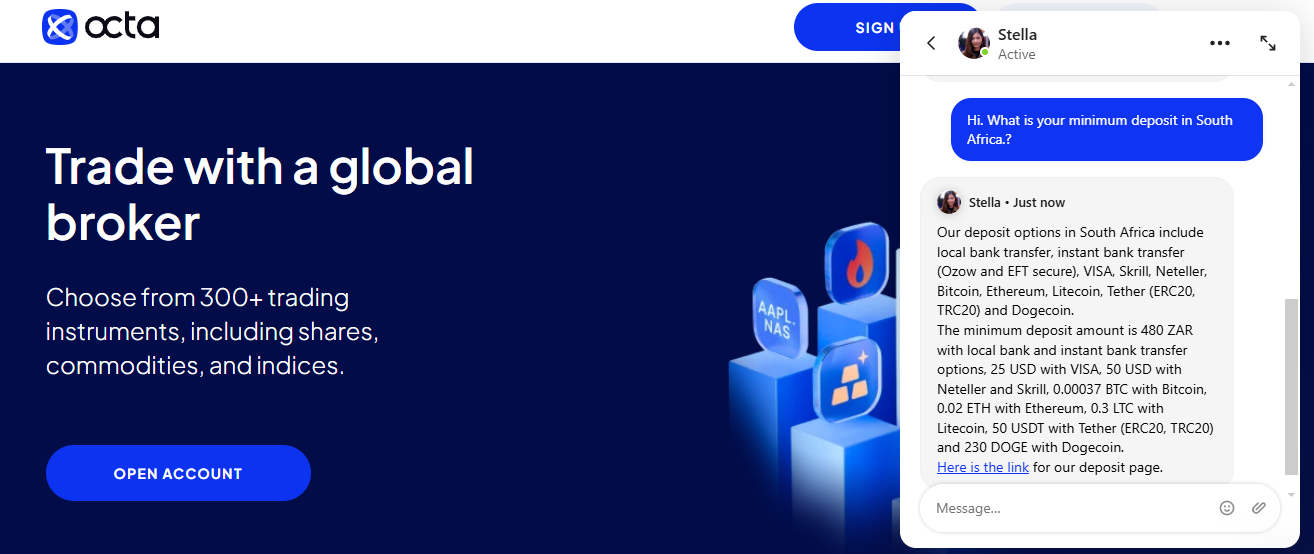

The minimum deposit on Octa in South Africa is ZAR 480 for bank deposits, $25 for deposits via Visa card and €50 for deposits via MasterCard.

How do I Deposit Funds?

Follow the steps below to deposit funds into your Octa Account:

Step 1: Log in to your Octa personal area via my.octafx.com/login.

Step 2: Click on the ‘Deposit’ tab and select the account you want to deposit into.

Step 3: Select the payment method you want to use and follow the prompts to complete your deposit.

What is Octa Minimum withdrawal?

The minimum withdrawal amount on Octa is R90 for local bank accounts and $20 for withdrawals to cards and $5 for e-wallets.

How to Withdraw Funds from Octa in South Africa?

Follow the steps below to withdraw money from your Octa Account:

Step 1: Log in to your Octa personal area via my.octafx.com/login.

Step 2: Click on the ‘Withdraw’ tab and select the account you want to withdraw funds from.

Step 3: Select a withdrawal method and follow the online prompts to complete the withdrawal request.

Note that you need to verify your account before you can initiate withdrawals.

To verify your account, you need to provide a valid means of identification. You can go to https://my.octafx.com/verification/ to upload the document or send it via the Octa support email.

Trading Instruments

Octa offers a relatively limited range of trading instruments, and fewer CFD trading instruments when compared with other brokers.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 52 Currency pairs Octa |

| Stocks | Yes | 150 stocks on Octa |

| Cryptocurrencies | Yes | 34 Cryptocurrencies on Octa |

| Energies | Yes | 3 Energies on Octa |

| Indices | Yes | 10 Indices on Octa |

| Metals | Yes | 2 metals spot on Octa (gold and silver). |

| Shares | Yes | 100+ shares on Octa without leverage (US and European shares). |

| Intraday Assets | Yes | 21 intraday assets on Octa. |

Trading Platforms

1) MetaTrader 5: Octa supports MT5 trading applications, available on web-platform (web-trader), desktop (Windows and macOS), and mobile devices (android and iOS).

2) OctaTrader: Octa has a proprietary WebTrader that is accessible on the web on laptops or mobile devices.

3) Octa Trading App: Octa supports a proprietary mobile application for trading which is available on Google Play and Apple App Stores.

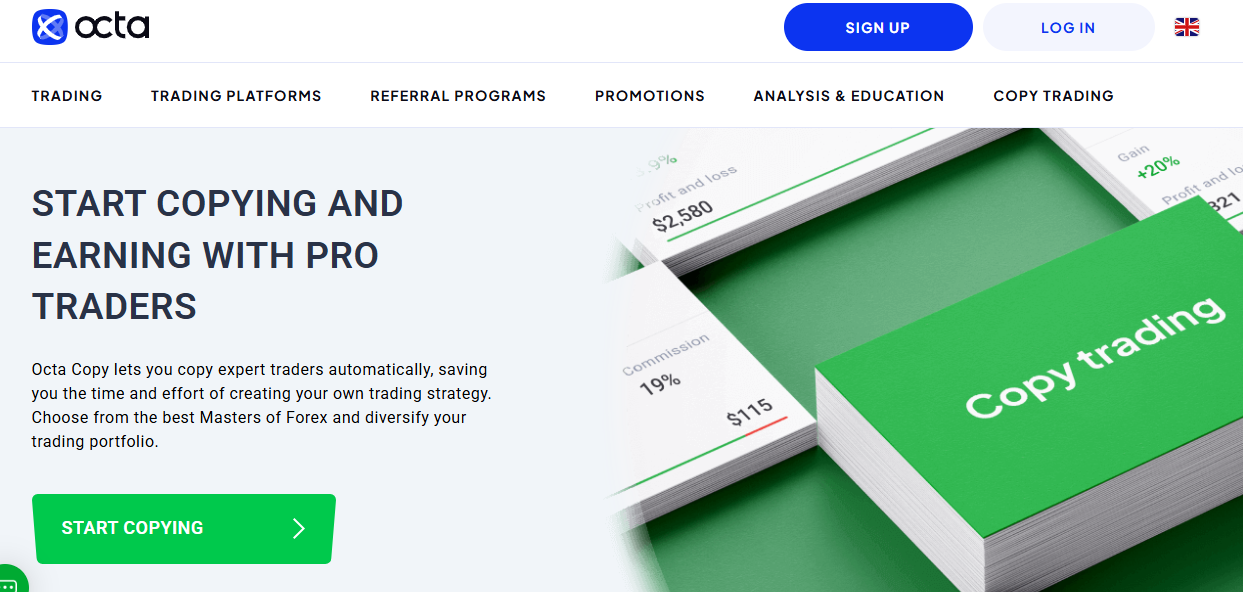

4) Octa CopyTrading App: Octa offers a mobile application for copy trading which is available on Google Play Store only. The Octa CopyTrading app is also available on the web.

Octa CopyTrading

CopyTrading on Octa is a feature that is designed for traders that do not want to trade on their own and would rather copy the trades of other traders, known as Master Traders. This allows especially new traders, known as ‘copiers’ to profit from the knowledge and trading experience of professional Forex traders by automatically copying the trades the Master Traders make.

How Does CopyTrading Work?

The way Octa CopyTrading works is that the Copiers select a Master Trader in the ranking list to copy, then make an investment deposit which will be used for the trading, and whenever the Master Trader opens a trade order, the same trade order is opened automatically in the trading account of the Copier, when the Master Trader closes a trade order, the order is also closed on the Copiers trading account.

The copier does not need to manually copy the trades, it happens automatically. The Copier can choose to copy the Master Trader trade in equal volume or 2 times the volume of the trade or even three times.

The Octa CopyTrading App is the dedicated app for CopyTrading, different from the regular Octa trading app. The OctaFX CopyTrading app can be downloaded from the Google Playstore on Android or Apple App Store on iOS devices, it is also available on desktop and web trading.

How to Start CopyTrading on Octa

The first step to start copy trading is to fund your CopyTrading wallet with a minimum investment sum of $25 (ZAR 455), some Master Traders require higher minimum investments. If you have funds in your Octa trading account already, you can simply do an internal transfer to your CopyTrading wallet.

The next step is to select a Master Trader whose trade you want to copy from the ranking list. You should go through the list of Masters to check their trading history and performance, and then choose the one you prefer. Keep in mind that different Master Traders have different settings so you might have to adjust your balance accordingly.

After choosing a Master Trader, the Copiers are all set to copy their trades and benefit from the expertise of professional traders.

A revenue share percentage (%) commission is charged for the overall profit that Copiers make, and the commission is paid to the Master Traders. If Copiers make no profit, then no commission will be charged. The commission is charged weekly or when Copiers reduce investment or unsubscribe from a Master. The Master determines the commission amount for copying orders. The commission can range from 0% to 50% of the Copier’s gain.

Octa introduced a new system that calculates the required investment, although every Master has a required investment that is calculated automatically by the Octa algorithm.

The calculation is based on the maximum margin used by the Master as well as the orders’ lot sizes that are placed by the Master within the last 7 active days.

Octa Education and Research

1) Webinars: Octa webinars gives you access to various information that will improve your trading. Octa has up to 16 speakers that handle various sessions on their webinars. These sessions include live trading sessions and news trading sessions. Specific topics like risk management, smart money concept, and trading psychology.

The webinars have also been structured so that you can learn at your level. There are webinars for all levels of experience and there some for beginners. You can find past webinars on Octa’s YouTube channel.

2) Articles: Octa offers trading education via their articles. They cover various forex trading topics but in a random manner. To maximize these articles, it is better to have a basic knowledge of forex trading. Then, you can use the articles as a means of continuous learning. An article should take you about 10-20minutes to read.

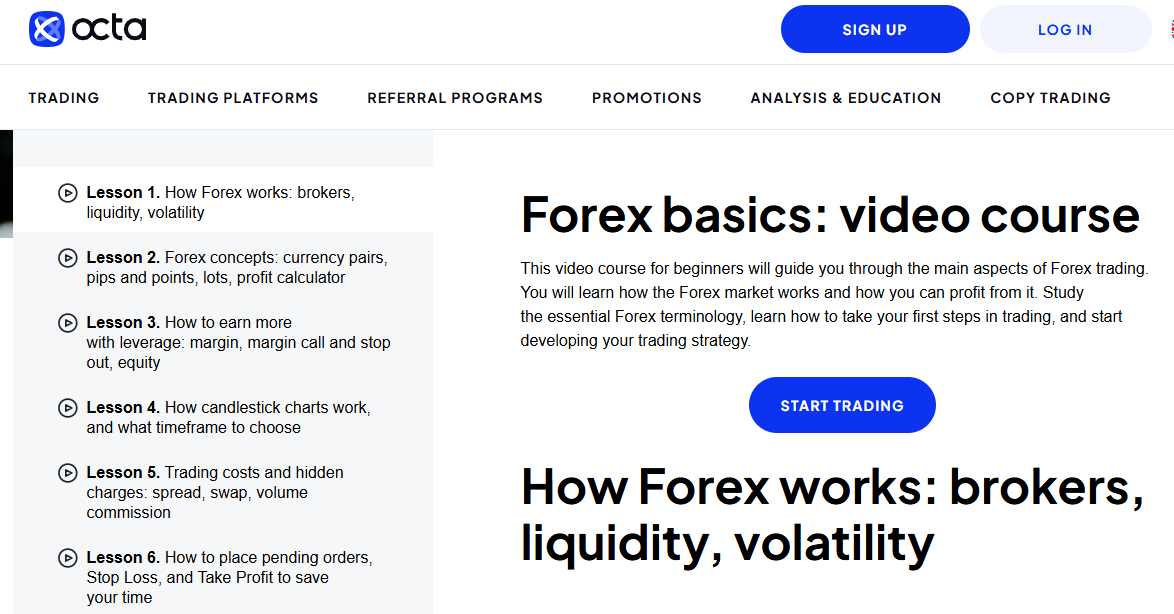

3) Video Course: Before reading Octa articles, we recommend you take their basic forex course on forex trading. There are 11 lessons there covering forex concepts, candlestick patterns, trading costs, an how to use fundamental analysis. You will also learn how the forex market works and how to develop your trading strategy.

4)Platform Tutorials: These tutorials help you be acquainted with your trading platforms. The tutorials are in videos and written articles. You can watch how to start trading with MetaTrader 4 and MetaTrader 5. You can also these trading platforms from the tutorial page.

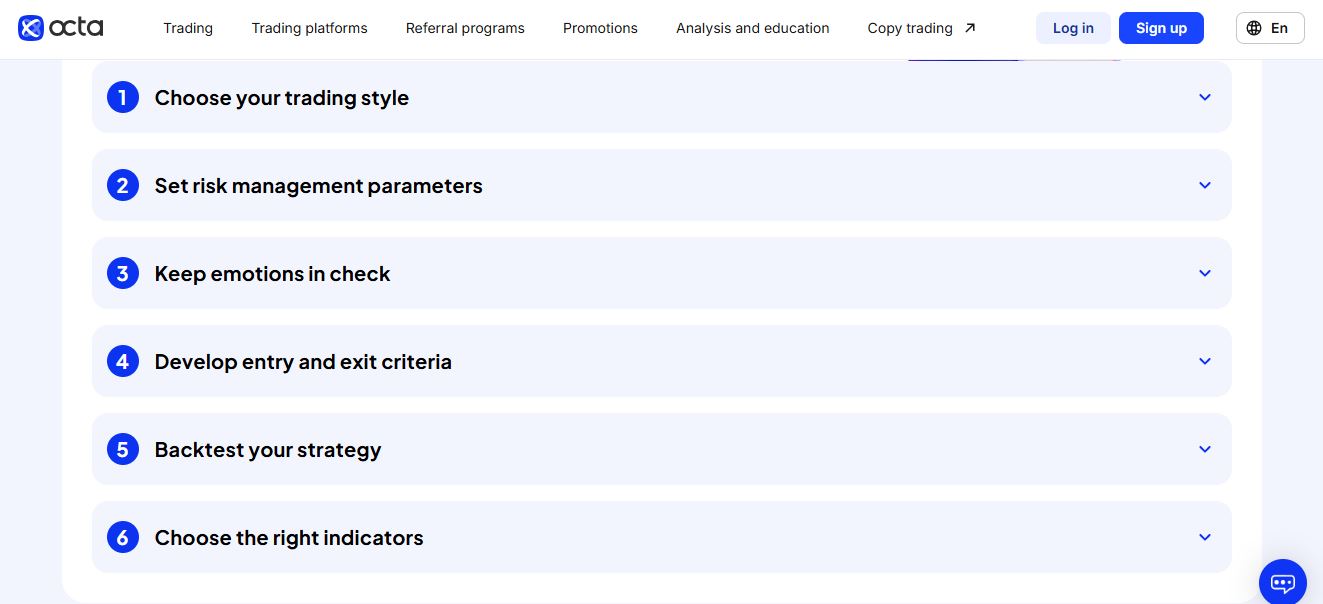

5)Trading Strategies: You can learn about trading strategies on Octa’s website including some AI knowledge. So the website list six steps to developing your personal trading strategy. Here is the list below:

After this, you can read any of the 15 articles covering different subjects on trading strategy. The articles cover identifying price patterns with AI, candlestick patterns, trading with Fibonacci etc.

Note: The education materials are not financial advice. They do not guarantee any result.

6) Glossary: If there are terms that you are not clear about, you can use Oct’s glossary. It is easy to navigate because all terms are arranged in alphabetical order.

Octa Execution Policy

On Octa’s website, you can find their execution policy under their ‘customer agreement’ section. Here is a summary of how the forex broker handles your orders.

Octa provides Market Execution on all trading instruments. The model of execution applied is ECN/STP. This means your orders are transferred to interbank liquidity providers. However, some orders may fail to offset or Octa might choose not to upset them. This happens in some cases.

Because Octa provides market execution, there is a high likelihood that your orders might be opened or closed at a price different from your requested price. Unlike some brokers who strive to get the next best price for you in this situation, Octa deems this slippage natural and will not bear any responsibility for it. This is because the price deviation (opening/closing) is due to the available liquidity.

Furthermore, Octa does not allow the use of arbitrage strategies. Arbitrage strategies carry along with them latency abuse, price manipulation, and time manipulation. If you are found using these strategies, Octa might cancel your orders, cancel your profits, close all your trading accounts, and refuse to allow you to open a new one. Also, addition, orders less than 180 seconds can be considered abuse and cancelled too. This means scalping is not allowed as well.

Customer Support

Octa offers 24/7 customer support options for traders via 2 channels. Our team tested the live chat and email support, here is our review.

1) Live chat: The response from the Octa live chat was fast, there was no wait time. The live chat is accessible on their website, and unlike most live chats, you do not need to enter your email address to start the chat.

Some representatives could not answer some questions and referred us to send an email enquiry instead. Some chat agents declined to answer some questions, claiming they could only give such information to registered Octa traders.

2) Email support: The email response was fas. First, there was an auto-generated message with a ticket created for our inquiry, and then a representative replied in less than 5 minutes. The answers to the questions asked were relevant.

Although we could not keep talking in the email thread and had to send new emails for new questions, no response was received under the thread for the previous email response.

We also tested the direct email form on the contact us page of the Octa website but got no feedback. The responsive Octa email address is [email protected].

Both live chat and email support are available 24/7.

Octa Bonus

Octa promotions program currently offers a 50% deposit bonus to traders on a minimum deposit amount of $50 (ZAR 900). The bonus is not automatic, as clients will have to apply for the bonus after their account is credited with the deposit sum.

Traders can withdraw the Octa bonus after they meet a trade volume requirement of half the bonus amount in lots. For example, if a client receives a $50 bonus (ZAR 900) on a $100 (ZAR 1800) deposit, the bonus amount will be locked and released for withdrawal when trade volume is equal to half of $50 ($50 divided by 2), which is 25 lots.

You can learn more about the bonus and the rules that apply in the promotions sections of the Octa website.

What Is The New Name Of OctaFX?

OctaFX’s new name is ‘Octa’

In 2023 Octa made a press release announcing that they are adopting a new brand identity and this included a change of name.

One of the reasons for changing their name was because they believed they have now outgrown the ‘FX’ in their name and are ready to increase the range of instruments they offer to include commodities, Stock Indices, Stocks, and Cryptocurrencies.

Do we recommend Octa?

Octa is regulated with FSCA in South Africa and is considered a moderate-risk broker because they are not regulated by a Tier-1 financial regulator, and traders in South Africa are currently registered under their FSCA license, but the counter party is their foreign entity. Octa is a market maker broker.

There are ODP licensed Forex Brokers in SA, if you want to trade with a locally regulated counter party, that would ensure the better transaction reporting under FSCA.

The overall fees are low for most Forex pairs & CFD instruments, and there are methods for local bank deposits & withdrawals in South Africa. The broker does not charge swap fees and commissions on trades. Their Copy Trading feature is also popular.

The number of tradable instruments on Octa is few, which means they may not have some instruments that you want to trade.

Although their customer support responds fast, the answers by some of their chat assistants were not very satisfactory. After every chat and email, the system sends a feedback form, for users to rate the support received with a thumbs-up or thumbs-down, and a space for comments which is optional.

The registration process to open an account on Octa is simple and fast. Although they require traders to verify their accounts before they can withdraw funds.

We recommend that you read more on the broker’s website and chat with the support to answer any questions you have before you register with the broker.

Octa South Africa FAQs

What is the minimum deposit for Octa?

The minimum deposit on Octa in South Africa is ZAR 480 for bank deposits and OZOW, $25 for deposits via Visa card, €50 for deposits via MasterCard and $5 for e-wallets like Netteler.

Is Octa trading legit?

Octa is a legit online forex broker that is regulated in South Africa with FSCA (but they are not an approved ODP). Their parent entity is registered in Comoros Union and regulated by the Mwali International Services Authority.

Octa is also licensed by the CySEC and they serve their EU clients through this licence.

Is Octa registered in South Africa?

Octa is regulated by the FSCA (Financial Sector Conduct Authority) in South Africa under the name Orinoco Capital (Pty) Ltd, with FSP number 51913, issued in 2021.

How long does Octa withdrawal take?

Octa withdrawal takes between 1-3 hours for the request to be processed by the finance team, and may take additional 1 hour for the funds to reach your account. This applies to all payment methods, and the process can be faster for some.

How much money can we withdraw from Octa?

You can withdraw as little as ZAR 90 or USD 5 on Octa, depending on the payment you are using. You can withdraw to your South African bank account, card or e-wallet.

Is Octa a good broker for beginners?

Yes, Octa has beginner friendly features for those that are new to online forex trading such as educational resources and demo accounts for practice that can be helpful for beginners to learn and understand how trading works and the Octa platform.

Octa also has negative balance protection, low spreads and offers commission-free and swap-free trading which will al contribute to lower fees as a beginner. However, it’s important to do your own research and practice with the demo account before trading with real money.

Can I make money from Octa?

Note that there is no guarantee that you will make profits at Octa (or any other CFD broker). The broker only facilitates your trades (on whichever instrument you place it), and may act as a counter party to your trades in case it is a market maker, as in case of Octa.

In theory, you can make money through Octa if you know how to trade forex and CFD instruments, but you can also lose money. You can make money by making profitable trades, but if your trades are losing, then you will lose money. You should know that forex and CFD trading is highly risky and you can lose your money as well.

Is Octa available in South Africa?

Yes, Octa operates in South Africa, and traders in South Africa can create an account on Octa and trade financial instruments as CFDs. They even allow you make deposit and withdrawal in Rand. Octa is also regulated in South Africa by the FSCA (not an approved ODP though).

Note: Your capital is at risk