| Octa Minimum Deposit Summary | |

|---|---|

| Octa Minimum Deposit | 480 ZAR |

| Deposit Methods | Bank transfers, cards, E-wallets (OZOW) |

| Account Types | OctaTrader Account, Octa MT4 Account, Octa MT5 Account, and Swap-free Islamic account |

| Deposit Fees | No Fees. |

| Account Base Currencies | USD |

| Withdrawal Fees | No Fees. |

| Visit Octa | |

Octa has a minimum deposit of 480 ZAR ($25).

It is a popular choice for forex and CFD traders around in South Africa. If you’re based in SA and considering opening an Octa account, one of your first questions is probably, “How much do I need to get started?”

Let’s break down Octa’s minimum deposits, accepted payment methods in South Africa, deposit rules, and everything else you should know before you fund your trading journey.

What is the minimum deposit for Octa?

Octa Minimum deposit for SA-based traders is R480, which is applicable for local bank transfer deposit method and as well as OZOW e-wallet. Visa cards require a minimum deposit of US$25 while Mastercards require a minimum deposit of €50.

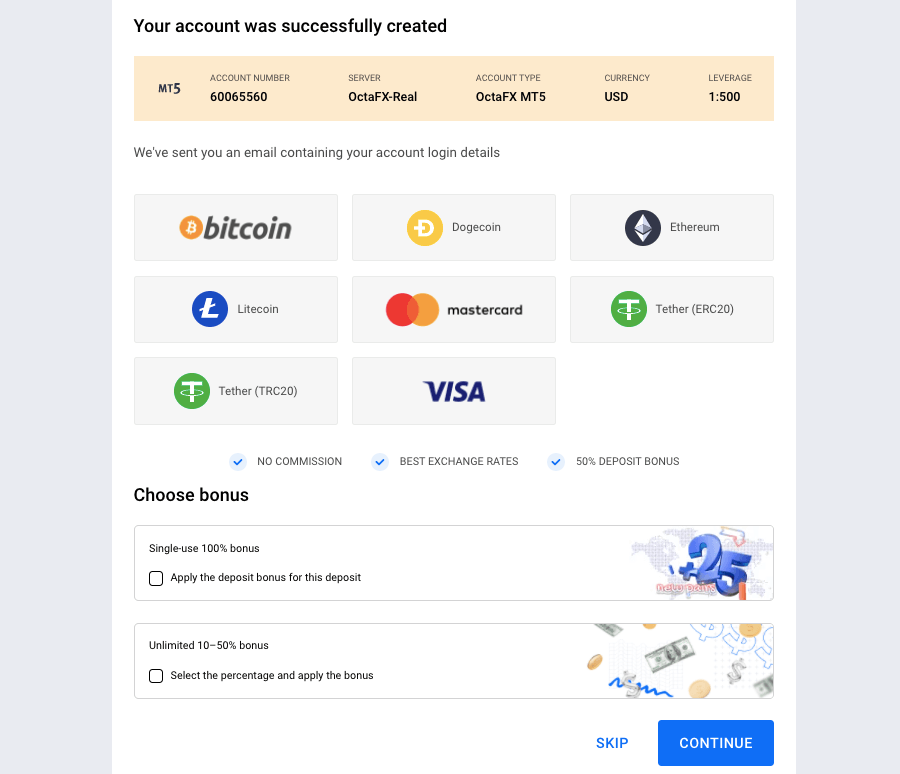

Although Octa offers 3 account types, the OctaTrader Accounts, MT5 Accounts and MT4 Accounts, they all have same minimum deposit requirement. Octa recommends a minimum deposit amount of US$100 to enable you place sizable trades.

Overall, the minimum deposit on Octa in South Africa depends on the payment method you are using.

Accepted Deposit Methods on Octa South Africa

Octa offers a range of ways to deposit into your trading account:

1)Credit/Debit Cards (Visa, MasterCard): You can use cards to get money into your trading account. The minimum deposit using a card is US$25 (or your currency equivalent) for Visa cards and €50 for Mastercards. Deposits via cards credited almost instantly (1-5 minutes).

The minimum withdrawal via cards on Octa is US$20, and only Visa cards are supported for card withdrawals. They are processed within 1-3 hours, and may take an additional 30 minutes to transfer the funds. Your card issuer may take a couple more hours to credit your account.

While Octa doesn’t typically charge fees, your bank or card issuer might, so always verify that.

2) Bank Wire Transfers: Octa accepts deposits via local bank transfers in South Africa. Bank transfers are ideal if you’re depositing larger amounts.

The minimum deposit via bank transfer on Octa is 480 ZAR. Processing times are slower, it can take 1-3 hours for the funds to reflect in your trading account.

Withdrawals to South African bank accounts require a minimum of 90 ZAR. These withdrawals are processed within 1-3 hours and may also take about an hour or more for the funds to reach your bank account, depending on your bank.

Octa doesn’t impose fees for bank transfers, but again, your bank might have charges for outgoing transactions and incoming transactions.

3) E-wallets (OZOW): Octa offers another convenient option for South African traders to make deposits to their account, which is the OZOW e-wallet. The minimum deposit amount for OZOW is R480, and the funds arrive in your trading account instantly.

However, Octa doesn’t support withdrawals to OZOW e-wallets.

Octa doesn’t charge deposit fees for this method either.

Note: CFD trading is risky

Octa Deposit Methods Table

Here is a summary of payment methods accepted by Octa for deposits.

| Deposit Methods | Availability | Minimum Deposit | Charges | Processing time |

|---|---|---|---|---|

| Internet banking/bank transfers | Yes | R480 | Free | 1-3 hours |

| Cards | Yes | $25 | Free | 1-5 minutes |

| E-wallet (OZOW) | Yes | R480 | Free | Instant |

Octa Deposit Rules

1. Deposit Fees: Octa often doesn’t charge deposit/withdrawal fees, however, your bank, card issuer or payment provider might charge independent fee. Double-check with them to avoid surprises.

2. Deposit Time: You can make deposits to your trading account at anytime. Deposits via OZOW e-wallets are credited instantly, cards are credited within 1-5 minutes, while bank transfers 1-3 hours to be credited.

3. Payment Source: Always deposit from accounts (bank, cards, e-wallets) held in your own name. Third-party deposits are prohibited.

As standard practice, you will be required to submit your government ID and proof of address for verification.

How do I deposit money into my Octa account?

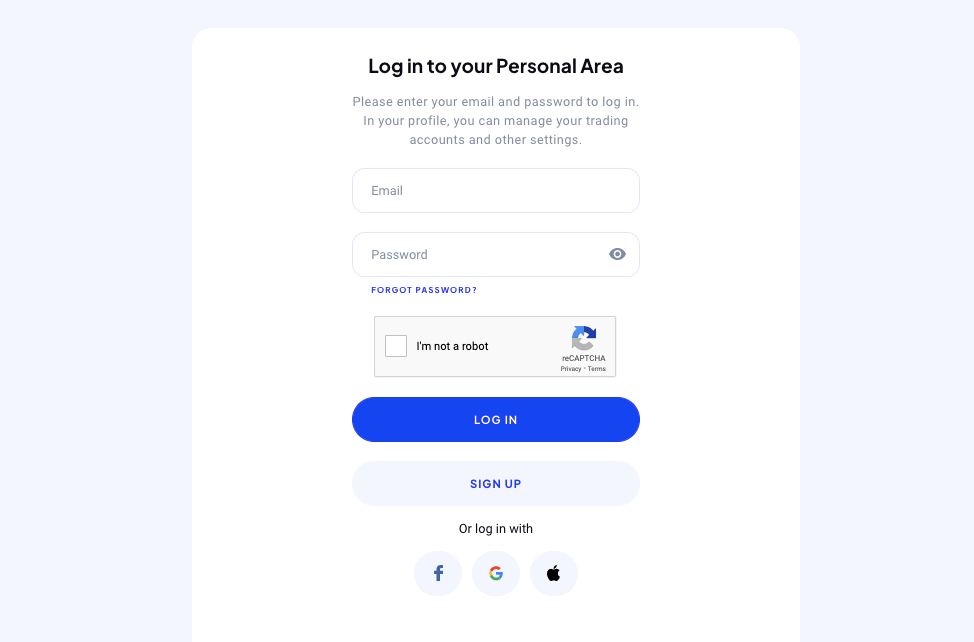

Step 1) Sign in to your Octa dashboard through my.octafx.com/login.

Step 2) Find the deposit tab and click on it, then choose your preferred payment method.

Step 3) Enter the amount you want to deposit and provide the necessary details required.

Step 4) Review the selections you’ve made, then confirm deposit to initiate it.

Comparison Of Octa Minimum Deposit With Other Brokers

Here is a comparison of Octa minimum deposit with that of their competitors.

| Broker | Minimum Deposit |

|---|---|

| Octa | 480 ZAR |

| HF Markets | 100 ZAR |

| Exness | R191 ($10) |

| AvaTrade | 1,915 ZAR ($100) |

| Plus500 | 1,915 ZAR ($100) |

| XM Trading | 100 ZAR ($5) |

Note: CFD trading is risky

Octa Minimum Deposit South Africa FAQs

Is OctaFX legal in South Africa?

Yes, Octa is regulated in South Africa. They operate under the name Orinoco Capital (Pty) Ltd and are regulated by the Financial Sector Conduct Authority (FSCA) as financial service providers (FSP).

This means Octa adheres to South African regulations, providing a degree of security for your funds.

What is the minimum amount in OctaFX?

The minimum deposit in Octa depends on your payment/deposit method. The most accessible option, bank transfer, requires only a R480 minimum deposit to get started.

OZOW e-wallets also requires R480, while Visa cards have a minimum deposit amount of $25 and Mastercards is €50.

How much is the deposit fee in OctaFX?

Octa generally do not charge any deposit fees for the supported payment methods. This includes popular options for South African traders like credit/debit cards, OZOW e-wallets, and bank transfers.

Of course, always double-check with your bank or e-wallet provider, as they might have their own independent fees.

Does OctaFX have a ZAR account?

No, Octa does not offer ZAR as an account currency. During account creation, you can only use USD as base account currency. However, you deposit to your account using ZAR on Octa and the funds will be converted to the based currency of your account.

How do I withdraw from OctaFX in South Africa?

You can withdraw from your Octa account to your local bank account or Visa card. The minimum deposit amounts are R90 and $20 respectively.

To initiate a withdrawal on Octa, first log in to your dashboard, then locate the ‘Withdraw’ tab and click on it.

Next choose the trading account you want to withdraw funds from, choose a method for withdrawal (bank account or card), then enter the amount you want to withdraw and confirm.

How fast is OctaFX withdrawal?

Usually it takes within 1-3 hours to process the withdrawal (during business days) and another 1 hour to transfer funds. However, the actual time it takes for the funds to reach your bank account or card can depend on external factors like the speed of your bank’s processing or card issuer.

Note: Your capital is at risk